Rajiv Mathur is surprised by the criticism for the proposed LTCG tax. “Why should anybody mind paying 10% of his gains in tax?” asks the Delhi-based retiree who has been investing in equity mutual funds for almost two decades. Mathur’s portfolio is not very big because he cashed out last year to fund the purchase of a house. His total investments in equity funds is only Rs 2 lakh, and his gains are unlikely to cross the tax-free limit of Rs 1 lakh for several years.

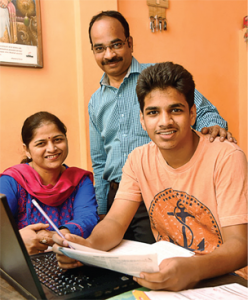

But Mumbai-based Preeti and Uday Salunke are in a different boat. With an equity fund portfolio of roughly Rs 15 lakh and SIPs of Rs 25,000 a month, their investments are growing and could attract tax when they withdraw in a few years. Their best bet is to start investing in the name of their son Aditya. Gifting money to a child above 18 and then investing it is a perfectly legal strategy. “You can gift any amount to your child without any tax liability,” says Sudhir Kaushik, Cofounder and CFO of Taxspanner.

In Pic: Preeti and Uday Salunke with son Aditya

Equity fund portfolio: Rs 15 lakh

Their equity fund portfolio is not very big and the gains are not likely to cross the Rs 1 lakh tax-free threshold for a few years.

What they should do

Their son Aditya turns 18 this year. If they invest in mutual funds in his name, they will be able to distribute the gains and avoid the tax in later years. Take help of adult child

Tax rules say that after a person turns 18, he is a separate individual and his earnings will not get clubbed with his parent’s income. If the Salunkes invest in Aditya’s name, he will not only be eligible for the Rs 1 lakh exemption for capital gains but also the Rs 2.5 lakh basic exemption and the Rs 1.5 lakh deduction under Sec 80C. Effectively, he is not getting into the tax net for several years.

In another part of Mumbai, PSU manager Ajay Bajaj and his wife Supriya are sizing up their equity portfolio. With almost Rs 32 lakh in stocks and mutual funds, they are likely to cross the Rs 1 lakh threshold very soon. However, they are not too worked up by the LTCG tax. “Even after paying 10% tax, equity will remain my preferred investment option because it gives far better returns than any other asset class,” says Ajay.

In Pic: Ajay and Supriya Bajaj

Equity fund portfolio: Rs 32 lakh

They have a sizeable equity portfolio and the gains are likely to become taxable.

What they should do

They should churn their portfolio and harvest capital gains every year. This will ensure that the cost of acquisition keeps rising and their capital gains remain within the tax free limit.

Harvest gains regularly

Investors like the Bajajs should get into the habit of harvesting their gains on a regular basis. Even if they intend to hold a stock for the long term, it makes sense to churn the portfolio. Don’t get us wrong. We don’t want you to time the market. All we are saying is that you sell your stocks to book longterm capital gains, and then buy back the same scrips.

Buying the same stocks again means you reset the acquisition date and can book short-term or long-term losses if the stock prices recede from these levels. Suppose you bought 1,000 shares of a company at Rs 150 apiece in February 2018 and the stock rose to Rs 220 by March 2019. You would have made long-term gains of Rs 70,000. If you sell all the shares in March 2019, and buy them back, your acquisition price will be reset to Rs 220 and the date of acquisition will become March 2019. Now if the stock rose to Rs 300 in another 12 months, your gains will only be Rs 80,000 and still tax free because it is below the Rs 1 lakh limit.

On the other hand, if you had not sold off at Rs 220, your acquisition price would have been Rs 150 and your total capital gain would have been Rs 1.5 lakh. Of this, Rs 50,000 would have been subject to tax.

While churning the portfolio helps you save tax, it also pushes up your brokerage costs. Every time you buy and sell, you pay a small fee to the brokerage. Consider signing up with low-cost brokers such as Zerodha who charge a very low flat fee on transactions.

How to calculate capital gains

After the LTCG tax, a lot of investors are worried about how to calculate their gains and the tax payable. This is where Value Research’s portfolio tracker can be very useful. The online portfolio tracker will calculate the taxable long-term capital gains made on stocks and equity funds. It uses the grandfathering cut-off date of 31 January 2018 to calculate the LTCG. It will be especially useful for investors with a large equity fund portfolio.