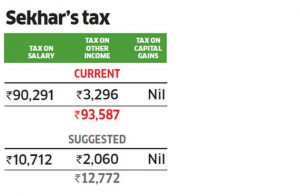

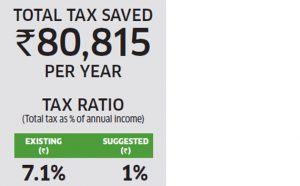

Chandra Sekhar pays a very low tax but there is scope to save a large portion of it. Taxspanner estimates that it can be reduced by over Rs 80,000 if he pays rent to his father and claims HRA exemption, his company offers him the NPS benefit and he invests more in the scheme himself.

Sekhar lives with his wife in his father’s house in Coimbatore. If he pays rent to his father, he can claim HRA exemption. If the entire Rs 2.7 lakh is exempt from tax, his tax will come down by almost Rs 56,000. However, Sekhar’s father will be taxed for this income after a 30% standard deduction. Since his father does not have income of his own, this will not be a problem.

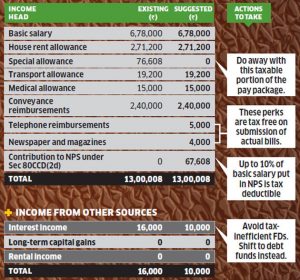

Income from employer

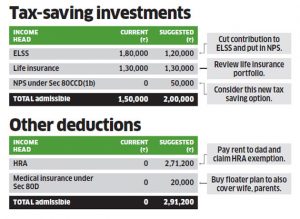

Sekhar’s company does not offer retiral benefits. If it does away with special allowance and instead puts 10% of Sekhar’s basic salary in the NPS under Sec 80CCD(2d), his tax will come down by almost Rs 14,000. Another Rs 5,150 can be saved if Sekhar puts Rs 50,000 in the NPS on his own under Sec 80CCD(1b).

At 32, Sekhar should opt for the Aggressive Lifecycle Fund (LC-75) which puts 75% of the corpus in equity funds.

Sekhar’s parents and wife are not covered by any medical insurance plan. If he buys medical insurance for them at a cost of Rs 20,000, his tax will reduce by Rs 2,000. Tax can also be saved by shifting from FDs to debt funds.

Write to us for help

Paying too much tax? Write to us at etwealth@ timesgroup.com with ‘Optimise my tax’ as the subject. Our experts will tell you how to reduce your tax by rejigging your pay and investments.