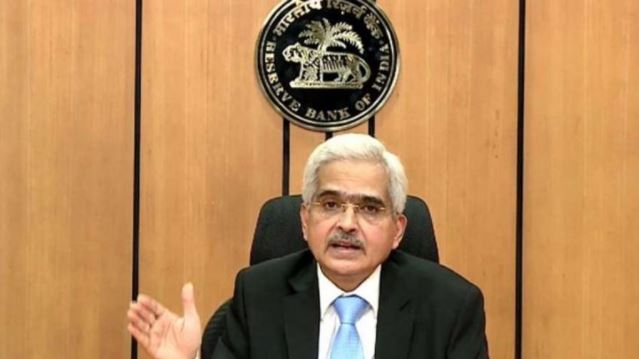

The Reserve Bank will not extend the loan moratorium beyond 31 August. According to the instructions of the Reserve Bank, banks can now implement their policies in relation to the stranded loans in the next few days. Bankers say that once the restructuring of the loan is allowed, it is not right to move the moratorium.

Banks are not allowed to reduce the interest rate under the moratorium. This increases the EMI after the moratorium period is over. At the same time, under loan restructuring, banks can relax the terms of the loan for two years. Due to this, the EMI of the borrower decreases. The Reserve Bank had announced on August 6, that by March 1, 2020, the loan customers who have defaulted for more than one month will get the benefit of loan restructuring.

Also Read: Lic’s policy will earn a lifetime by giving a one-time installment, such as take advantage

RBI has increased that moratorium

During the lockdown due to coronavirus infection, in view of the problems of reducing the salary of the people and leaving the job, the RBI had given the facility of loan moratorium. But now its period is not going to extend beyond 31 August. Under the loan moratorium facility from RBI, customers had the option to postpone EMI. That is, they were given the option to pay EMI during this period.

Keeping in mind the convenience of the customers in view of Corona, RBI had earlier granted a three-month extension on all term loan payments from March 1, 2020 to May 31, 2020, but later extended it to three months till August 31, 2020. was given. However, now there are indications from the Reserve Bank that it will not be extended further.