New Wage Code: Even if the new labor law is implemented, it is being said that the in hand salary will be reduced. But, it will definitely have other benefits. The special thing is that at the time of retirement, a salaried person can also become a millionaire. But, for that, EPF calculation has to be taken care of.

New Wage Code latest news in Hindi: New labor laws are yet to be implemented. But, for the last 2 years, their discussion is in full swing. A total of four labor codes will be implemented in the country. Most of the states have given their consent to the draft rules. Labor Minister Bhupendra Yadav has expressed hope that the new labor laws will be implemented soon. Preparations have been completed by the Labor Ministry. The salaried workers will benefit the most when the New Wage Code is implemented. They will have more corpus deposited in the Provident Fund. According to experts, even though there will be some reduction in the monthly in hand salary, the retirement fund will accumulate more through EPF. Only your EPF account can make you a millionaire.

New Wage Code Calculation

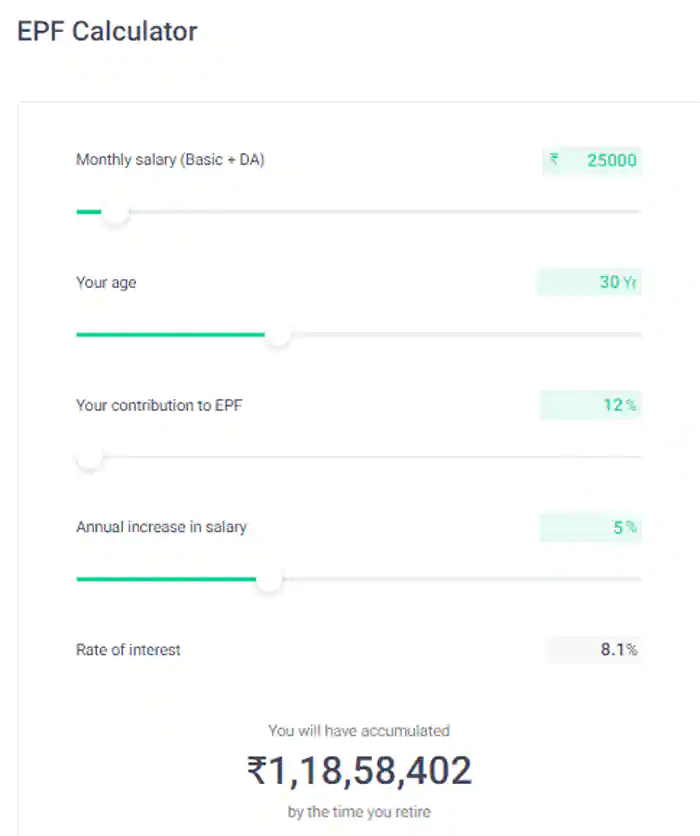

On the implementation of the New Wage Code, let’s assume that the basic salary of an employee is 25 thousand rupees per month. In such a situation, the total amount of EPF with him on retirement will be Rs 1,18,58,402. An annual increment of 5 percent has also been kept in this calculation, which will increase the EPF fund further.

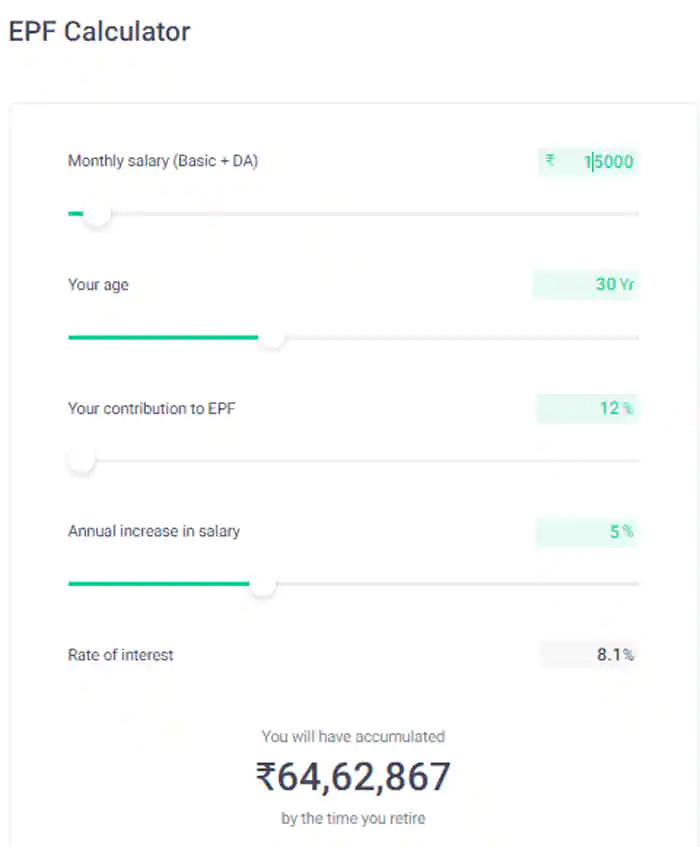

If we look at the current conditions, the monthly salary of an employee is Rs 50,000 and the basic salary is Rs 15,000, then the amount of PF on retirement will be Rs 64,62,867.

What is the cost to company?

CTC is the expenditure incurred by a company on its employee. This is the complete salary package of the employee. CTC includes Monthly Basic Pay, Allowances, Reimbursement. At the same time, products like gratuity, annual variable pay, annual bonus are included on an annual basis. The amount of CTC is never equal to the employee’s take home salary. CTC has many components so it is different. CTC = Gross Salary + PF + Gratuity

Basic salary

Basic salary is the base income of an employee. It is fixed based on the level of all the employees. It varies according to the rank of the employee and the industry in which he is working.

Gross salary

- PF Calculator New Wage Code: The salary which is made by adding basic pay and allowances without deducting tax is called gross salary. This includes bonus, overtime pay, holiday pay and other itemized allowances.

- Gross Salary = Basic Salary + HRA + Other Allowances

Net salary

- Net salary is also called take home salary. The salary that is made after deducting tax is called net income.

- Net Salary = Basic Salary + HRA + Allowances – Income Tax – EPF – Professional Tax