Follow this investment strategy using mutual funds to ensure a worry-free retirement. Your retirement income can easily beat inflation.

- If you follow a disciplined approach and start investing regularly from your early thirties then you can easily avoid misery during retirement.

- If your current age is 30 years, and your monthly expenses are Rs 50,000 then it will grow to Rs 2.16 lakh by the time you turn 60.

- A monthly investment of Rs 20,000 for 20 years can help you meet the rising expenses during retirement

Often people ask a question about how to secure a monthly income, that rises every year, in-line with inflation, after retirement. There may not be any concrete answer to this question. But this could be possible if you follow a proper investment approach using mutual funds. In an emerging market like India, equity mutual funds, as an asset class, has the potential to deliver between 10-12% annual return over the long term (over 15 years). Experts say if you follow a disciplined approach and start investing regularly from your early thirties then you can easily avoid misery during retirement and can secure an income that rises in line with inflation and will also allow you to leave behind a huge sum of money for your loved ones.

At present, an average retired couple needs around Rs 50,000 per month to have a comfortable post-retired life provided they have their own house. But this amount will increase to Rs 2.16 lakh after 30 years assuming an annual inflation rate of 5%. Also, this amount will rise every year after your retirement.

If you start investing in mutual funds from the age of 30, for only 20 years, you can easily accumulate a corpus by the time of your superannuation (at 60) that can provide you pension income for the next 25 years (till the age of 85 years and more) and also you can leave a hefty amount for your legal heir after your death.

Use SIP to create a retirement corpus

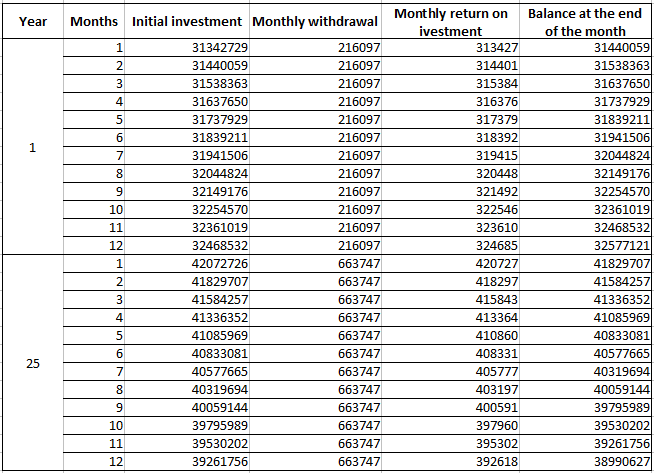

Assume that your current age is 30 years, and your monthly expenses are Rs 50,000. To maintain your current lifestyle even after retirement you need to invest Rs 20,000 every month for the next 20 years in diversified large-cap mutual funds through the systematic investment plan (SIP). If your SIP investment generates an annualised return of 12%, your investment will grow to Rs 10,091,520 in 20 years (by the time you turn 50). This corpus will grow to Rs 31,342,729 by the time you retire (at the age of 60) even if you do not make any additional investment between the age of 50 and 60.

Use SWP after retirement to get monthly pension

At the age of 60, your monthly expenses would have grown to Rs 2.16 lakh assuming an annual inflation rate of 5%. Also, this monthly expense will grow every year. So, set up a step-up systematic withdrawal plan (SWP) in the equity mutual fund to withdraw the above-mentioned amount every month and increase the withdrawal amount by 5% every year. Your retirement corpus will be sufficient enough to provide you the above-mentioned monthly income.

How it works

Source: Times Now

As you can see from the above illustration, if you withdraw Rs 2.16 lakh every month in the first year of your retirement from your retirement corpus through SWP, the remaining amount in your account at the end of first year will be nearly Rs 3.26 crore. From the second your, you can withdraw 5% more, Rs 2.27 lakh, to offset the impact of inflation and continue this every year for your entire retired life. By the time you turn 85, you would be drawing Rs 6.64 lakh monthly and the remaining amount in your mutual fund account would be Rs 3.90 crore.

Worth mentioning here is that in the above calculation, your remaining corpus in your MF account will start depleting from the 19th year onwards as your monthly withdrawal will be more than the return generated from your accumulated corpus.

In the above illustration, we have assumed that the expected annual return of 12% will accrue evenly every month at the rate of 1% per month throughout your retired life. However, in reality, this may not be the case. In some year your may witness capital erosion as in some years you may get more than 12% return so that your overall return over the long term will be 12%. But your retirement corpus is sufficient enough (as the monthly withdrawal rate is less than 1% at the beginning of retired life) to withstand the capital erosion for few years.