Atal Pension Yojana Form PDF Download | Atal Pension Application Form PDF | Atal Pension Yojana was launched on 1st June 2015 by the Government of India. The benefit of this scheme can be availed on attaining the age of 60.

Under the scheme, the applicant has to deposit the premium every month. For which the beneficiary has to register his application for Atal Pension Yojana in the age of 18 to 40 years.

Under Atal Pension Yojana 2021 , the amount of pension invested by the beneficiaries will be according to the age. After which the applicant will get pension after the age of 60. Other necessary documents like Aadhar Card, Ration Card, Age Proof, Bank Pass Book, Mobile Number will be required for Atal Pensn Yojana.

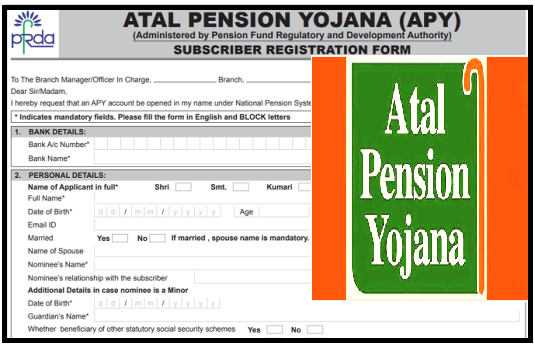

How to fill the form of Atal Pension Yojana? To apply, the applicant has to attach all the necessary documents along with the Atal Pension Yojana Form. After which the applicant will have to submit all these documents to the concerned department.

| Article | Atal Pension Yojana Application Form |

| Department | finance department |

| Beneficiary | Citizens of the country |

| The profit | of pension |

| Official website | Click Here |

| Atal Pension Yojana Form PDF | Atal Pension Yojana PDF Form |

Eligibility Criteria or Features

The candidates have to fulfill the following eligibility criteria to avail the benefits of Atal Pension Yojana.

- The applicant must be an Indian citizen.

- His age must be between 18 to 40 years.

- The minimum contribution period for APY is 20 years. Only after that the government will provide the guaranteed minimum pension.

- Aadhar and mobile number are mandatory documents for KYC of beneficiary, spouse and nominee.

- Apart from this, candidates can also submit ration card or bank passbook for residence address proof.

- Candidates monthly pension of 1,000 to 5,000 bucks can make choosing a regular monthly contribution between.

- Citizens can also choose to increase or decrease their pension amount once a year (in the month of April).

- The Government of India combines this scheme with PM Jan Dhan Yojana to automatically deduct the contribution from the bank account.

Benefits

- Atal Pension Yojana provides protection for aging Indians.

- In Atal Pension Yojana, you can be entitled to more pension every month by depositing less amount.

- In case of untimely death, you can also get the benefit of your family.

- On the death of the holder of this pension scheme, in the event of the death of his wife and wife also, the children will continue to get pension.

- To get a lifetime pension, you do not have to deposit money in this account for life.

- Like the PF account, the government will also contribute on its behalf in this pension scheme.

Documents Atal Pension Yojana 2021

A very easy process has been kept to open APY bank account. For which the necessary documents of the applicant person will be required. The list of those documents is as follows –

- Aadhar Card.

- Mobile Number.

- Identity Card.

- Proof of Permanent Address.

- Passport size photo.

How to apply for Atal Pension Yojana online

You can open your APY account in any national bank. Or you should have any old bank account. So that you can deposit your Atal Pension Yojana installment. For this you have to login to your bank’s website. As such we will provide you the information about opening State Bank of India (SBI) online APY account below as an example. For which you must also have the facility of net banking.

- To apply SBI Atal Pension Yojana online, you have to log in to SBI.

- Where you have to click on e-Services. After which you have to click on Social Security Scheme.

- Here you will get three options of PMJJBY/PMSBY/APY. Out of which you have to click on APY (Atal Pension Yojana).

- Now Atal Pension Yojana Online Form will be open on your screen . In which you have to enter all your information. Such as account number, name, age and address etc.

- After which, you have to further select the pension options. Which will determine the premium based on your age. In this way, your account under Atal Pension Yojana will be opened within 1 day.