HIGHLIGHTS

- For each notice from the tax department, a particular procedure needs to be followed to file a reply

- The department can pick up ITRs for scrutiny till up to six months from the end of the financial year in which the return was filed.

A little more than 58,000 taxpayers, who filed their income tax returns (ITR) for financial year (FY) 2017-18, have been served notices of scrutiny. The income tax department has selected 58,322 cases for scrutiny, under the first phase, under the e-Assessment Scheme 2019 for income tax returns (ITR) filed for FY18 or assessment year (AY) 2018-19. The e-notices were served before 30 September 2019.

There has been an increase in the number of scrutiny notices issued this year and a lot of those who have got notices declared foreign income and assets in their ITR, said experts. “We are witnessing a jump of more than 30% in cases selected for scrutiny assessment this time around. Individuals earning foreign income seem to be a focus area for the tax department,” said Shilpa Bhatia, director-tax, Ashok Maheshwary and Associates Llp, a chartered accountancy firm. Archit Gupta, founder and CEO, ClearTax, a tax filing and investing portal, also told Mint that there’s a spike in the number of scrutiny cases related to tax returns of assessees who declared foreign income and assets.

The department can pick up ITRs for scrutiny till up to six months from the end of the financial year in which the return was filed. So if the tax return for FY17-18 was submitted on or before 31 July 2018, scrutiny notices can be issued till 30 September 2019.

Nature of notices

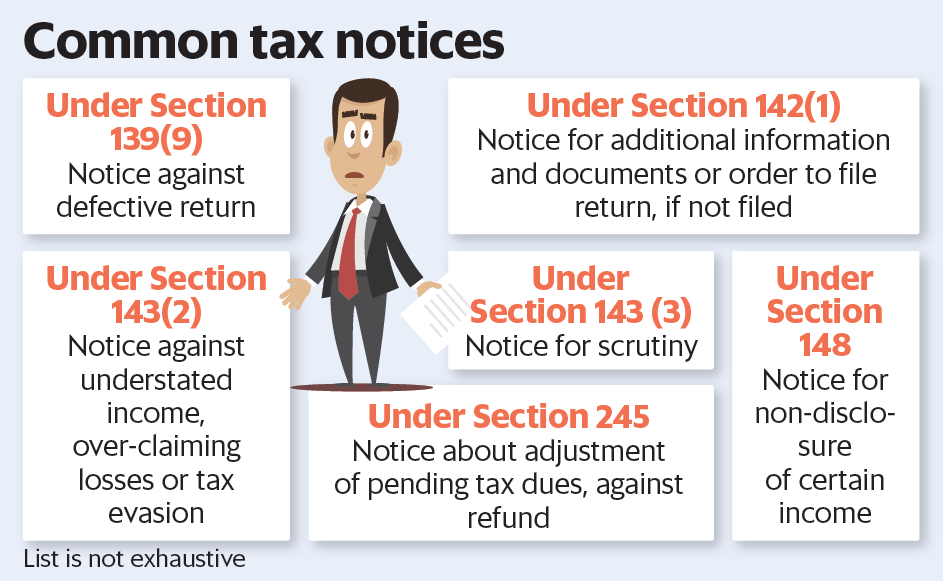

Typically, scrutiny notices are issued by the department for verification, regular assessment or reassessment or for limited scrutiny. Where the department needs any information or clarification in relation to assessment of ITR, notices under Sections 142(1) and 143(2) can be issued, asking for information or details of ITR.

If the notice is about assessment or reassessment, you may have to undergo detailed scrutiny. Such notices come along with a questionnaire seeking information of a particular transaction, asset or income.

If the notice is related to limited scrutiny, you have to provide details of particular assets mentioned such as when it was purchased, its cost and source of fund. The notice will also specify the date before which such information and documents are to be submitted.

Replying to notices

While earlier taxpayers or their representatives were required to physically visit the tax department after receiving scrutiny notices, now there is a “e-proceeding” facility. The aim is to eliminate person-to-person contacts with tax authorities and make the process transparent and fast. Under “e-proceeding”, recourse is available to file electronic responses for all limited and complete scrutiny cases.

Besides sending emails and SMSes, the department also uploads tax notices, if any, in your e-filing account. Once you receive such an email, access your income-tax account and see if any demands or arrears are pending in your name. You can reply to almost all tax notices online through the account.

Once you receive a notice, go through it carefully and respond within the time frame mentioned. For each notice from the tax department, a particular procedure needs to be followed to file a reply. Most of these responses can be filed online through your income tax account, unless the department has specifically asked you to appear personally.

Remember that replying to a tax notice is a must. If you fail to comply with the notices, you may end up paying a penalty or facing prosecution, depending on the case. The penalty can be as high as 300% of the dues and the jail term can go up to seven years.

If you fail to respond to tax notices because of genuine reasons, you should request for an extension either by approaching the respective assessing officer or through the department’s online portal. If you find income tax notices complicated, get the help of a chartered accountant or other experts.