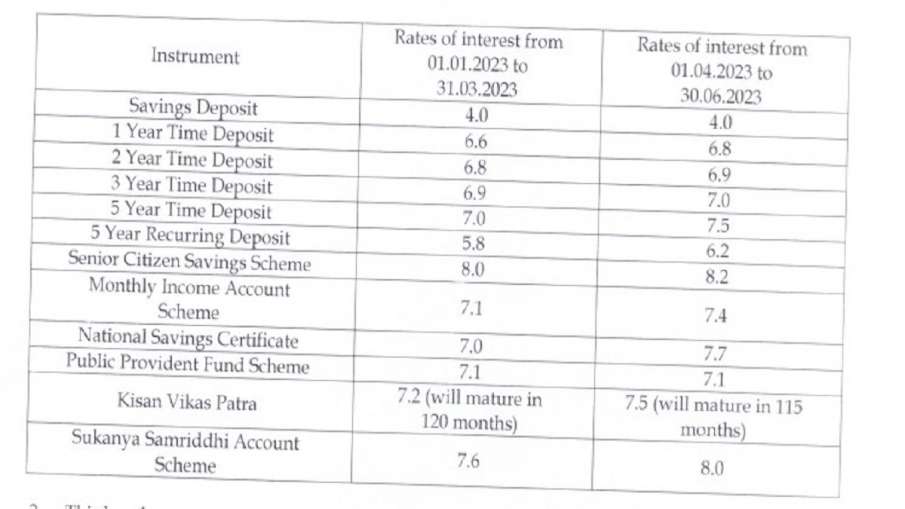

The government has increased interest rates on small savings schemes by up to 70 bps for the April-June 2023 quarter.

The government has increased interest rates on small savings schemes by up to 70 bps for the April-June 2023 quarter. The Finance Ministry has made this announcement through a circular issued on March 31, 2023. Let us tell you that one percentage point is equal to 100 basis points.

According to the information given by the government, interest rates on Senior Citizen Savings Scheme, Monthly Income Savings Scheme, National Savings Certificate, Kisan Vikas Patra, all post office time deposits and Sukanya Samriddhi Account have been increased. However, there has been no change in the interest rate on Public Provident Fund ie PPF. Interest will be available on PPF only at the rate of 7.1 percent.

Interest for Sukanya Samriddhi increased from 7.6% to 8%

The Finance Ministry said this in a statement on Friday. However, interest rates on popular deposit scheme PPF and savings deposits with banks have been kept unchanged at 7.1 per cent and 4 per cent, respectively, for the April-June quarter. In other savings schemes, interest rates have been increased from 0.1 percent to 0.7 percent. The maximum increase in interest has been done in National Savings Certificate (NSC).

On this, from April 1 to June 30, 2023 , 7.7 percent interest will now be available, which was 7.0 percent till now. The interest for Sukanya Samriddhi, a savings scheme for girls, has been increased from 7.6 per cent to 8 per cent. The interest rate for Senior Citizen Savings Scheme has been increased from 8 percent to 8.2 percent and for Kisan Vikas Patra (KVP) from 7.2 percent to 7.6 percent has been done. Kisan Vikas Patra will now mature in 115 months instead of 120 months. The interest rate was increased in the last quarter also.

Interest rates for small savings schemes are revised every quarter. With this amendment, the interest on deposits in the post office for one year will be 6.8 percent (till now 6.6 percent), for two years 6.9 percent (till now 6.8 percent), for three years seven percent (till now 6.9 per cent) and 7.5 per cent for five years (seven per cent till now). Interest on Public Provident Fund has been retained at 7.1 per cent and on savings deposits at 4 per cent.

Interest on Monthly Income Scheme has been increased by 0.3 percent to 7.4 percent. It is noteworthy that in order to control rising inflation, the Reserve Bank of India (RBI) has reduced the policy rate i.e. Repo 2 from May last year.5 percent has been increased to 6.5 percent. Along with this, interest rates on deposits have also increased.

How are interest rates determined?

The interest rates on small savings schemes are reviewed by the government every quarter. The formula for calculating the interest rate for small savings schemes was given by the Shyamala Gopinath Committee. The committee recommended that the interest rates of various schemes should be 25 to 100 bps higher than the yield on government bonds of similar maturity.