SIP Vs PPF: By saving ₹5000 every month, you can get either ₹16.27 lakh in PPF or ₹23.79 lakh through SIP in 15 years. While PPF is safe, SIP gives high returns but with risk. Invest only after understanding the advantages and disadvantages of both.

SIP vs PPF: If you start saving ₹5000 every month, is SIP better or PPF? This question arises in almost every middle class family. On one hand there is PPF which gives guaranteed returns and tax exemption, on the other hand there is SIP i.e. equity linked investment of mutual fund, which can give higher returns in the long term. Let us understand both the options as per the investment of ₹5000 per month in a period of 15 years.

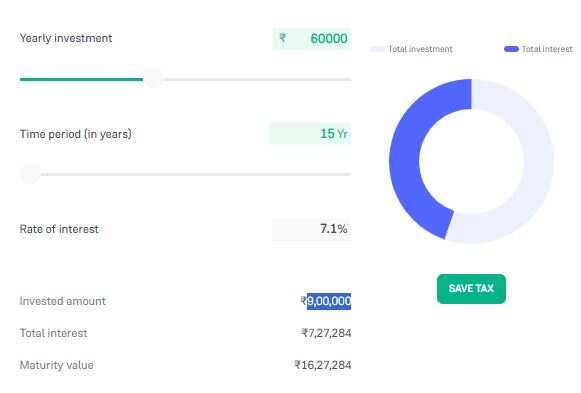

Investing ₹5000 per month in PPF: How much will you get?

PPF (Public Provident Fund) is a safe and tax-free investment option backed by the government. Currently, the interest rate on PPF is 7.1% per annum (till May 2025). Its lock-in period is 15 years.

- Month: ₹5000

- Annual investment: ₹60,000

- Total investment (15 years): ₹9,00,000

- Interest rate: 7.1% compounded annually

- Maturity amount: Approximately ₹16,27,284

- Total return: ₹7,27,284

Note: PPF interest is revised every quarter, but here we are assuming 7.1% for consistency.

Investing ₹5000 per month in SIP: How much will you get?

SIP (Systematic Investment Plan) is a method of investing in mutual funds. If you do SIP in Equity Mutual Funds, you can get an average annual return of up to 12%, although this is not guaranteed.

- Month: ₹5000

- Annual investment: ₹60,000

- Total investment (15 years): ₹9,00,000

- Average return: 12% compounded annually

- Maturity amount: approximately ₹23,79,657

- Total return: ₹14,79,657

Note: Returns in SIP depend on the market and can fluctuate. There is also risk involved.

SIP vs PPF: Which will give more benefit on an investment of ₹5000?

| Plan | total investment | Interest / Returns | Maturity Value |

|---|---|---|---|

| Public Sector Undertakings (PPF) | ₹9 Lakh | ₹7.27 lakh | ₹16.27 lakh |

| SIP | ₹9 Lakh | ₹14.79 lakh | ₹23.79 lakh |

Which is better in tax?

1. PPF

Comes in EEE category – investment, interest and withdrawal – all three are tax free.

Under section 80C, exemption of up to ₹1.5 lakh is available.

2. SIP (except ELSS)

- Long Term Capital Gains (LTCG) tax is applicable on investments of more than one year.

- LTCG up to ₹1 lakh is tax free, after that 10% tax has to be paid.

Difference in risk and liquidity

PPF: There is no risk, but you cannot withdraw the entire amount for 15 years. Partial withdrawal is possible after 7 years.

SIP: There is market risk, but you can withdraw the fund partially or completely if needed.

Where will you get more money?

If you want safe investment with low risk and want to save tax, then PPF is a great option. But if your risk tolerance is a little higher and you want to get more returns, then SIP can prove to be a better option. SIP can give more returns up to ₹ 7.52 lakh in 15 years, but there is also risk with it.

FAQs: Common questions related to SIP vs PPF

1. Is there a guaranteed return in SIP?

No, SIP i.e. investment in mutual funds is market based. The return in this is not guaranteed, but in the long run, an average return of up to 10-12% can be obtained. The choice of investment and market conditions affect this.

2. What is the current interest rate in PPF?

Currently (Q1 FY 2025) PPF is getting 7.1% interest annually, which the government revises every quarter. Interest is compounded annually and is completely tax free.

3. Is there a tax exemption in SIP?

Only ELSS (Equity Linked Savings Scheme) SIPs are tax-exempt – up to ₹1.5 lakh under Section 80C. Other SIPs are not tax-exempt, and Long Term Capital Gains above ₹1 lakh are taxed at 10%.

4. Can I withdraw money mid-term in SIP or PPF?

PPF: There is a lock-in of 15 years, but partial withdrawal is possible after the 7th year, subject to certain conditions.

SIP: It has higher liquidity – you can withdraw funds at any time, although withdrawals in less than 1 year may be taxed and may attract exit load.

5. Which among SIP and PPF gives higher returns?

In the long term (10–15 years), SIP, especially in Equity Mutual Funds, usually gives higher returns than PPF. But it depends on the risk. If you want safety and tax free returns, then PPF is a better option.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com