Best FD Return: If we look at the FD rate of Fincare Small Finance Bank, it gives the highest interest of 7.50% every to senior citizens for a period of 3 years. While the regular interest is 7 percent.

FD Benefits: Fixed Deposit ie FD is seen as a low-risk investment. Although this is a very popular and old way of investment, but in recent times its trend has again intensified. Because banks or NBFCs are giving more interest to customers on all FDs. In this, especially senior citizens are getting more benefit. The offer of banks is also in terms of deposit period. In such a situation, we look at the interest rates offered by NBFCs and banks to senior citizens on FDs. Along with this, they also know that for how much period, how much interest will be received.

Where is getting the highest interest?

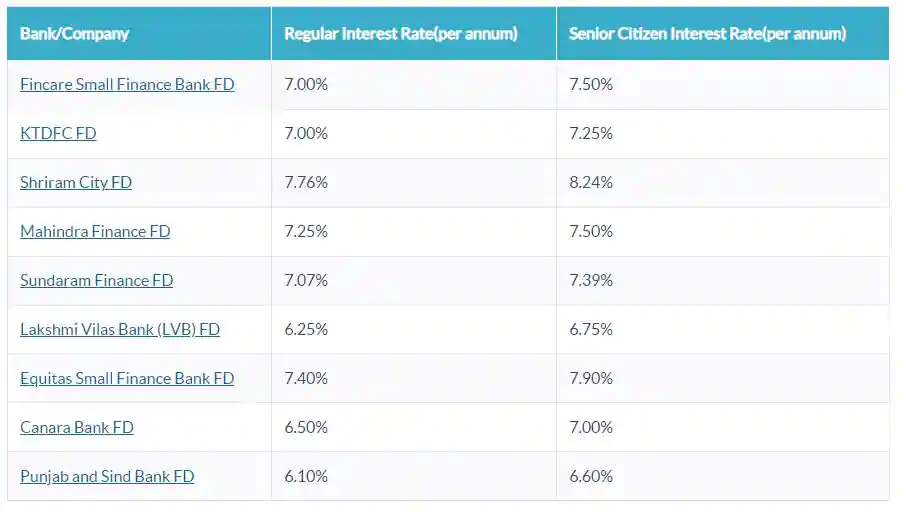

First of all, if we look at the FD rate of Fincare Small Finance Bank, it gives the highest interest of 7.50% per annum to senior citizens for a period of 3 years. While the regular interest is 7 percent. Similarly, Kerala Transport Development Finance Corporation is giving 7.25 per cent interest to its senior citizen customers. Offers 7% interest for general customers.

See full list here

The names of Shriram City, Mahindra Finance, Sundaram Finance, Equitas Small Finance Bank are included in the banks and NBFCs giving more than 7 percent return on FD. Explain that these interest rates available on FD are on an amount of less than Rs 2 crore with a period of 3 years.

How much will be benefited from FD?

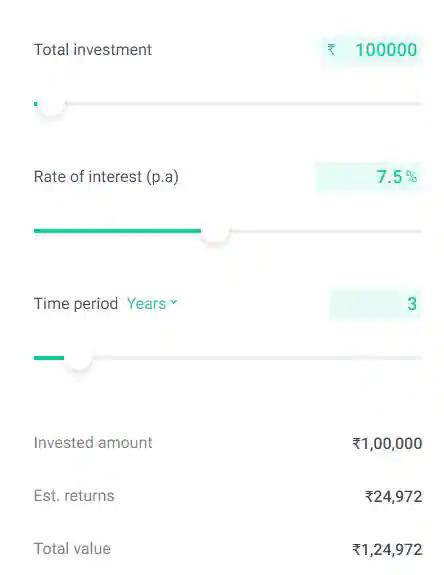

After knowing the FD rates of NBFCs and banks, now let us understand it from the figures. For example, if you have made an FD of Rs 1 lakh in Fincare Small Bank, which is for a period of 3 years. So you will get a profit of around 25000 rupees. That is, after 3 years your deposit amount which is Rs 1 lakh will increase to Rs 1.25 lakh.

Understand the complete calculation here