SBI has given a big gift to its customers on the new year, State Bank of India has increased the limit of Immediate Payment Service (IMPS), where earlier you were able to transfer only 2 lakhs, it has been increased to 5 lakhs .

Over time, the digital revolution has had an impact on the banking system. The effect of which is visible in common life. Nowadays, every small to big payment also wants to be done through digital medium. On the new year, SBI has given a special gift to its customers regarding digital payment. The limit of SBI No3 IMPS has been increased from two lakhs to five lakhs. Where you were able to do only 200000 transactions in a day, it has now increased to 500000.

SBI announced this by tweeting on Tuesday that the limit of Tatkal payment service has been increased and this service will be applicable from February 1, 2022. Let us tell you that you will not be charged any charge on the transfer from 200000 to 500000.

SBI has increased the IMPS transaction limit to Rs 5 lac with NIL charges for transactions done through digital channels. For complete details, visit: https://t.co/2wpOQD7XCS#SBI #DigitalBanking #IMPS #AzadiKaAmritMahotsavWithSBI pic.twitter.com/QVbHmlzXHF

— State Bank of India (@TheOfficialSBI) January 4, 2022

SBI said in a statement that to encourage customers to switch to the bank’s digital modalities, SBI will no longer charge any charges for digital IMPS transactions up to Rs 5 lakh. This transaction can be done through YONO App, Internet Banking/ Mobile Banking.

If IMPS is done by going to the branch, then how much will be charged

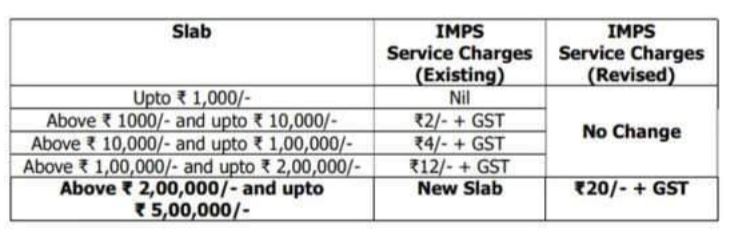

SBI has said in its statement that if a customer wants to send money through Immediate Payment Service (IMPS) by visiting any branch of the bank, then from February 1, 2022, there will be zero charge on the transaction up to Rs 1000. At the same time, the charge on transactions of more than Rs 1000 to Rs 5 lakh will be like this…

SBIin also said that if a customer sends money through National Electronic Funds Transfer (NEFT) digitally, no charges will be levied. Whereas for sending money through NEFT through a bank branch, you will have to pay Rs 2 to Rs 20 plus GST. Similarly, there will be no charges for sending money through RTGS (Real Time Gross Settlement) through digital medium. Whereas for doing RTGS through bank branch, Rs 20 to Rs 40 plus GST will have to be paid.