Aadhaar card and PAN card are one of the most important documents in India today. Without this, you will not be able to take advantage of any government facility or bank account. Recently, the government has issued an order to link PAN and Aadhaar with Aadhaar card. After this, crores of people across the country have followed it.

However, some people have missed linking PAN and Aadhaar together, who will now have to pay a fine of ₹1000. But this fine will be 10 times i.e. 10 thousand rupees when you will not be able to complete it by the next date i.e. 30 June 2023.

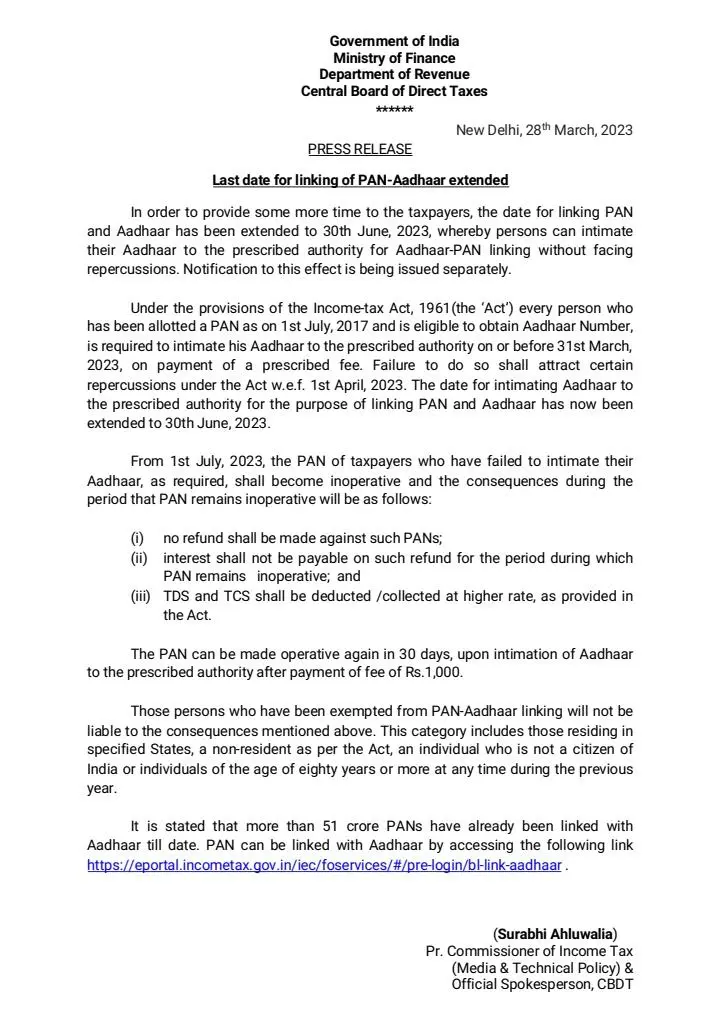

In such a situation, if you have not linked your PAN card and Aadhaar card, then you will have to link it before 30 June 2023 in any case. This date line was earlier fixed as 31 March 2023. But the government has extended it again and has given you a chance to link bank PAN and Aadhaar card.

If you do not link PAN-Aadhaar after this date, your PAN card will be deactivated. If this happens, then card holders will not be able to do things like mutual funds, stock market investments. Not only this, in today’s time, from opening a bank account to real estate or any other deal, PAN card is the most important document. So even though the deadline has been extended, it is prudent to get this work done as soon as possible without waiting for the last date.

When the Pan Card is deactivated, if you use it as a document for any financial work, then you can be fined up to Rs 10,000. Under Section 272B of the Income Tax Act, there is a provision for such fine.

You can link your PAN with Aadhaar by the following process

- Open Income Tax E-Filing Portal – https://incometaxindiaefiling.gov.in/

- Register on it (if not already done). Your PAN (Permanent Account Number) will be your User ID.

- Log in by entering User ID, Password and Date of Birth.

- A pop up window will appear, prompting you to link your PAN with Aadhaar. If not, go to ‘Profile Settings’ on the menu bar and click on ‘Link Aadhaar’.

- Details like date of birth and gender will already be mentioned as per PAN details.

- Verify the PAN details on the screen with the details mentioned on your Aadhaar. Please! Note that if there is a mismatch, you need to fix it in either document.

- If the details match, enter your Aadhaar number and click on the “Link Now” button.

- A pop-up message will inform you that your Aadhaar has been successfully linked with your PAN

- You can also visit https://www.utiitsl.com/ or https://www.egov-nsdl.co.in/ to link your PAN and Aadhaar.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com