Nowadays, everyone has a bank account. Salary, subsidies, and interest are all deposited into your bank account. But have you added a nominee to your account? This small step can save your family from major legal hassles and financial problems in the future. Let’s explore why adding a nominee to a bank account is important.

In today’s digital age, having a bank account isn’t just a necessity, it’s a necessity. Everything from salaries to government subsidies is done through your account.

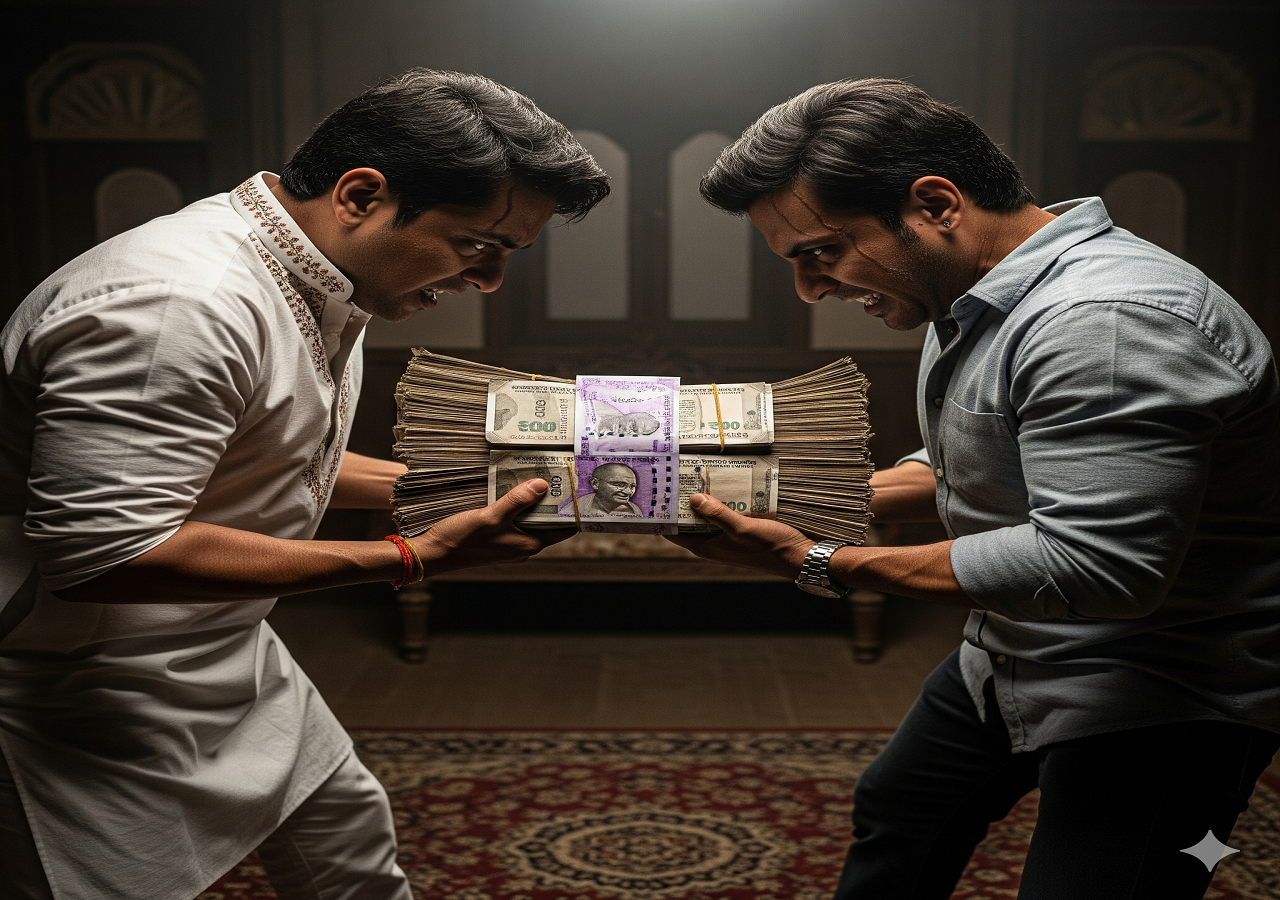

But if the account holder dies unexpectedly, who will receive the account balance? The answer is the nominee. Nominee is a person whom you authorize in writing to the bank that he can take the money from the account in your absence.

The RBI and banks have now made it almost mandatory to provide nominee details. This step saves the family from lengthy legal proceedings. The nominee can be someone close to you, such as a spouse, children, parents, or siblings. This ensures that the money reaches the right person easily.

Claiming a nominee is easy. You only need to provide a death certificate and ID proof. The bank will transfer the balance directly. If a nominee isn’t registered, the matter becomes complicated. Getting the money requires a succession certificate and going through court proceedings.

Opening a bank account is important, but adding a nominee is even more crucial. This small step can save your family from legal and financial difficulties.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com