Volatility in the rupee and prices of crude oil, carnage in midcaps and smallcaps, and trade tensions between US and China resulted in a lot of selling pressure in the week gone by

The market corrected by close to a percent this past week, but thanks to Friday’s rally of over one percent on value buying at lower levels, the losses were greatly minimised.

Volatility in the rupee and prices of crude oil, carnage in midcap and smallcap stocks and trade tensions between US and China resulted in a lot of selling pressure.

Broader markets continued to see sharp correction for the second consecutive week, despite recovering on the last day of the quarter, with the Nifty Midcap and BSE Smallcap indices falling 2.2 percent and 3 percent, respectively.

Both indices crashed 14 percent and 16.6 percent in first half of 2018, which was expected after their stellar rally in 2017. This year, they have underperformed the Nifty and Sensex, which gained 1.7 percent and 4 percent, respectively.

Bears continued to dominate Dalal Street, and their pressure looks like it is here to stay this coming week. Experts said that volatile trade too will remain in the week to come, adding that the focus would slowly shift from global cues to June quarter earnings, which will kick off in the second week of July.

“Nervousness in the market is expected to continue on negative global clues and we will see key indices trading in tight range for the next couple of weeks,” Gaurav Jain, Director at Hem Securities, told Moneycontrol.

Jain said rising fears of a trade war, higher crude prices, and tightening of economies across the globe have hurt the economy and market sentiment. “With no significant events in the coming week, global clues will continue to dominate trading sentiments and stock-specific approach will continue,” he said.

Rajeev Srivastava, Business Head – Securities and Commodities, Reliance Securities, told Moneycontrol that in the backdrop of higher fuel prices, higher interest rate and a weakening rupee scenario, the market may trade in a range and is unlikely to witness any strong appreciation in the next 6-8 months.

He advises investors to invest in quality stocks, which are less vulnerable to macro concerns and have healthy cash flow visibility.

Considering the likely pickup of rural consumption, corporate capital expenditure in the consequence of higher utilisation and recent reforms, Jain is hopeful that corporate earnings will witness double digit growth in coming quarters.

Here are 10 key factors that will keep traders busy next week:

Rupee

The Indian rupee hit an all-time low of 69.09 against the dollar during the week because of higher crude oil prices and strong demand from exporters and banks. It managed to recover 62 paise from the lowest level but failed to end the week on a positive note, ending 0.93 percent weaker at 68.47.

The domestic currency fell for the third consecutive month against the dollar in June and corrected 5 percent in the first quarter of FY19, the biggest quarterly fall since September 2013.

Multiple headwinds like a strong dollar, higher crude prices and concerns related to inflation and fiscal slippage dented sentiment, but interim Finance Minister Piyush Goyal has said that there is no need for a knee jerk reaction to the volatility.

“Rising oil prices, political risk in a pre-election year, low equity risk premia pointing towards relative high valuation and tightening financial conditions in the domestic economy are the major factors which is specifically hurting the rupee,” Anindya Banerjee of Kotak Securities told Moneycontrol.

He said a strong US economy is prompting the US Federal Reserve to tighten monetary policy, and fears of a trade war are affecting most emerging markets were therefore, not a rupee-specific risk.

As a result, carry trade, which is the biggest force driving currency markets, especially EM currencies, is on reverse gear for the rupee in 2018, Banerjee said.

Crude

After the announcement of an increase in supply by OPEC and its allies at their recent meeting, crude oil prices corrected sharply from a three-and-a-half-year high of $80.50 a barrel to around $73 a barrel, but rebounded towards $80 due to unplanned disruption in Canada, Libya and Venezuela.

Another reason why investors were worried were the US’ sanctions on Iran, the fifth largest oil producer in the world, which would reduce a big volume of crude from world markets at a time when demand is rising.

Brent crude futures, the benchmark for international oil prices, jumped 5 percent to $79.44 a dollar during the week.

“As India is the world’s third-largest oil consumer after US and China, with more than 80 percent of its oil demand met through imports, the soaring oil price environment will doubtlessly impact the Indian economy,” CD Equisearch said.

The research firm said market analysts believe that OPEC and its partners could choose to fill up the shortfall created by stress on oil production in Venezuela, Angola and Iran.

“Several countries that are a part of the deal have excess capacity to increase production. US oil producers will also seek to take advantage of the decrease in global oil production but may be confined due to infrastructure bottlenecks and paucity of demand for the extra light grade oil produced by them,” it said.

Auto Sales Data

Auto companies will release their June sales data on July 1 and July 2. So the stock reaction is likely on the coming Monday.

Maruti Suzuki, Tata Motors, TVS Motor, Ashok Leyland, Hero MotoCorp, Bajaj Auto, Eicher Motors, Escorts etc will be in focus.

“Interaction with leading channel partners indicates moderation in retail sales across segments, particularly in rural areas. This can largely be attributed to weak sentiment due to low farm realisations, a delay in the onset of monsoon, and lower crop disbursement by financial institutions,” Motilal Oswal said.

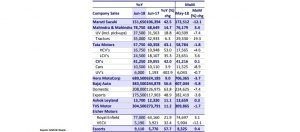

Motilal Oswal Expectations for June sales

Macro Data

Nikkei Manufacturing PMI for June will be released on Monday, followed by Services PMI for the same month on Wednesday.

Foreign Exchange Reserves data for the week ended June 29 will be announced on Friday. Deposit and bad loan growth numbers for the week ended June 22 will also be declared on same day.

Technical Outlook

The Nifty closed the June series below 10,600 levels on Thursday but managed to end the week above 10,700 due to sharp rally on Friday. It was a good start to the July series but bears retained their dominance at Dalal Street as the index lost a percent. Even the Midcap and Smallcap indices failed to get support from bulls as they lost 2-3 percent in a week despite recovery on Friday.

Rangebound move is likely to continue in the coming week and the crucial levels are around 10,550 on the downside and 10,850 on the upside, experts said.

“Index fell sharply from the higher levels and breached the intermediate support of 10,700. Friday’s recovery was quite strong and pulled the index back above 10,700 mark; however it has not damaged the bearish setup. If you got excited about bounce then we think it was a counter trend rise and not a fresh rally. Like we said earlier, bullish possibilities will open up only on a close above 10,900,” Gajendra Prabu, Technical Research Analyst, HDFC Securities told Moneycontrol.

Shabbir Kayyumi, Head – Technical & Derivative Research, Narnolia Financial Advisors said medium term view of range bound movement remains intact as long as indices trade above 10,550. “Nifty RSI near 50 marks also suggests sideways move in coming trading session. Confluences of Fibonacci retracement and 100 EMA round 10,570 levels imply robust support and Nifty will remain strong till it holds above this level.”

Downward sloping trend line connecting previous two major top of 11,121 and 10,929 suggests resistance at 10,850, he added. “Regression line is flat around 10750. We expect sideways movement for next few trading session. On the flip side, Nifty has to close below 10,550 to change this sideways movement thesis.”

Listings

Chemical manufacturer Fine Organic Industries is set to debut on bourses on Monday. The final offer price is fixed at 783 per share. The Rs 600-crore initial public offer was oversubscribed by 8.99 times during June 20-22.

After stellar response to the Rs 466-crore IPO, railways consultancy firm RITES is also going to list its equity shares on same day. The company after consultation with book running lead managers has fixed final issue price at Rs 185 per share. The IPO had garnered strong investor demand, with the issue getting oversubscribed 67.24 times during June 20-22.

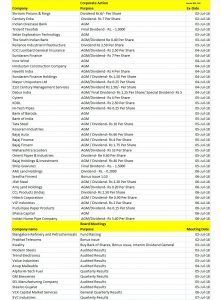

Corporate Action

Stocks in Focus

GVK Power: Company initiated the process to monetise its airport assets. Sources told CNBC-TV18 that Paris-based ADP, Singapore’S Changi, Candian Pension Fund and Private Equity Players may be interested in picking up stake.

IDBI Bank: The IRDAI board is likely to have discussed allowing LIC to buy controlling stake in IDBI Bank. Government sources say they will move a cabinet note only after all the regulatory approvals are in place, reports CNBC-TV18. Also former SBI MD B Sriram assumed charge as MD & CEO of the bank effective June 30.

Tata Steel: Company and Thyssenkrupp signed a definitive agreement to create a new European steel champion.

NMDC: Company & Kopano Logistics Services established a 50:50 joint venture company, Kopano-NMDC Minerals to undertake exploration & development of mineral properties in South Africa.

Cadila Healthcare: Zydus gets final approval from US FDA for Triamterene & Hydrochlorothiazide tablets USP.

TCS: Promoter and promoter group of company have communicated their intention to participate in a Rs 16,000 crore share buyback.

HDFC Bank: Managing Director, Aditya Puri told CNBC-TV18 that the bank has no plans to increase foreign branches at this point.

Bank of Maharashtra: MD & CEO RP Marathe & ED RK Gupta divested of functional responsibilties.

Reliance Industries: Company has signed an agreement to acquire US-based open telecom solutions provider Radisys for $1.72 per share in cash. The acquisition is aimed at accelerating Jio’s innovation and technology position in the areas of 5G, IOT and open source architecture adoption.

Viceroy Hotels: As part of the Resolution Process, the Resolution Professional has issued Form G to prospective resolution applicants to submit resolution plan for the company.

Shree Renuka Sugars: After completion of the open offer by Wilmar Sugar Holdings Pte. Ltd, Narendra Murkumbi has stepped-down as the Vice Chairman & Managing Director of the company. He will continue as non-executive director of the company.

Udaipur Cement Works: Approved a project at a capital outlay of Rs 37.50 crore at company’s plant for captive use, and also approved obtaining omnibus approval for raising of funds by way of issue of non-convertible debentures (NCDs) of upto Rs 200 crore at the forthcoming Annual General Meeting.

Parsvnath Developers: Brickwork has re-affirmed the rating ‘B’, assigned to Rs 360 crore non-convertible debentures (Series A) and Rs 244.39 crore non-convertible debentures (Series B) of subsidiary Parsvnath Rail Land Project.

Gujarat Lease Financing: Board has approved the merger of GLFL subsidiaries with GLFL.

Indian Metals & Ferro Alloys: The agitation has been called off with immediate effect. However there would be a loss of around 500 tonnes of ferro chrome production.

Salzer Electronics: Company to acquire two overseas companies – Advanced ID Asia Engineering, Thailand and United Marketing and Trading Limited, Hong Kong.

Welspun Enterprises has received provisional certificate for commercial operation of the Deihi-Meerut Expressway Package-Ol w.e.f. June 28.

Ujaas Energy: CRISIL assigned BBB+/Negative (downgraded from A-/Stable) rating for long term bank loan facilities and A2 (downgraded from A2+) rating for short term bank loan facilities.

Bharat Financial Inclusion completed the second securitisation transaction of Rs 815.75 crore in FY19. With this transaction, the company has completed two securitisation transactions worth Rs 1,365.82 crore in FY19.

Oriental Bank of Commerce has revised base rate from 9.45 percent per annum to 9.50 percent per annum w.e.f. 30.06.2018.

TCS board to consider financial results and interim dividend on July 10

Thermax has concluded an order of Rs 340 crore from a leading Indian steel manufacturer for a specially designed boiler, electric turbo generators and ancillary equipment for their production facility in Maharashtra.

Adani Transmission: Maharashtra Electricity Regulatory Commission approves acquisition of Reliance Infra’s Integrated Business of Generation, Transmission, Distribution and retail of power for Mumbai City by Adani Transmission.

Amber Enterprises: Company has extended the timeline to complete the acquisition of balance stake in Ever Electronics of 51 percent by December 31, 2018 in one or more tranches.

Bosch: Holding company Robert Bosch GmbH plans to sell the packaging machinery business.

Borosil Glass Works: ICRA has placed the long-term rating of A+ and the short-term rating of A1+ assigned earlier to Rs 40 crore Line of Credit on rating watch with developing implications.

Dilip Buildcon: Three wholly owned subsidiary companies have received the sanction letter from NBFC and Nationalized Bank to finance their Hybrid Annuity Mode (HAM) projects. Company is in advance stage to get the sanction for the remaining HAM projects to achieve the financial closure within the specified time period of the Concession agreement.

Esha Media Research has signed an agreement with Limelight networks, Inc, Tempe, AZ. USA.

Mayur Uniquoters: Guman Mal Jain, Chief Financial Officer has resigned due to some personal reason.

Punjab National Bank sold entire stake of 3,30,000 shares of ICRA through block deal at exchange platform for gross sale consideration of Rs 108.60 crore on June 28.

The New India Assurance Company board approved the allotment of bonus shares in the ratio 1:1

Global Cues

Japan’s Nikkei Manufacturing PMI and Foreign Exchange Reserve for June, China’s Caixin Manufacturing PMI for June, Europe’s Manufacturing PMI for June and Unemployment Rate for May, and US Manufacturing PMI for June will be released on Monday.

On Tuesday, US Factory Orders and Euro Area Retail Sales data for the month of May will be announced.

On Wednesday, US Auto Sales for June, China’s Caixin Composite and Services PMI for June, Japan’s Nikkei Services PMI for June and Europe’s Composite and Services PMI for June will be released.

US’ FOMC Minutes, Initial Jobless Claims for the week ended June 30, ADP Employment Change for June, Non Manufacturing PMI for June and Composite and Services PMI for June will be announced on Thursday. Europe’s Retail PMI for June will be released on the same day.

The US Balance of Trade for May, US Non-Farm Payrolls and Unemployment Rate for June, and Japan’s Household Spending for May will be declared on Friday.