If you are also a customer or policy holder and agent of Life Insurance of India (LIC of India), then you can take advantage of credit card for free. Actually, LIC CSL has recently issued Rupay Credit Card in association with IDBI Bank.

Lic Credit Card Apply, Lumine Platinum Card, Eclat Select Card, Benefits: If you are also a customer or policy holder of Life Insurance of India (LIC of India) and an agent, then you can take advantage of credit card for free. Actually, LIC CSL has recently issued Rupay Credit Card in association with IDBI Bank.

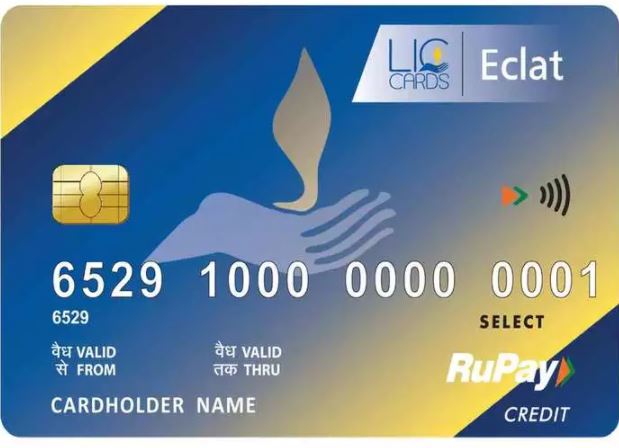

Which has been named Lumine Card and Eclat Cards Credit Card. At present, this credit card is only for LIC agents, members and policy holders. Further, there is a plan to give this to the general public as well.

There are many benefits of this credit card. If you pay LIC premium then 2 times reward point will be given. Apart from fuel surcharge on filling petrol, many other facilities are also available in these cards.

LIC and IDBI Bank have jointly launched both these credit cards. The first is LIC CSL Lumin Platinum Credit Card and the second is LIC CSL Eclat Select Credit Card.

What are the benefits of LIC’s Lumin and Eclat credit cards

- Good credit limit is given to the Lumin and Eclat cardholders.

- Lumin card holders get 3 Delight Points as a reward when they spend Rs.100.

- Eclat Credit Card earns 4 Delight Points for every 100 spends.

- If the cardholder pays LIC premium with this, then two times as reward points. That is, six to eight reward points for every Rs.100.

- Complimentary lounge access at domestic and international airports is also provided to LIC IDBI Eclat card holders.

- If you do a transaction of Rs 400 or more through these cards, then one percent rebate is given as fuel surcharge.

- If you do a transaction of more than 3000 then you can easily convert it in easy installments i.e. EMI.

- The special thing is that there is neither any processing fee nor foreclosure charge.

- If you want, you can convert your amount into EMI of 3, 6, 9 or 12 months as per your requirement.

- Accident insurance also covers these credit cards. That is, in case of accidental or normal death of the cardholder, the benefit of other attractive insurance coverage including cover, credit shield cover and zero lost card is also given to the nominee.

- However, this benefit will be available only if there has been a card transaction before 90 days from the insurance claim on your card.

- You also get Welcome Bonus Points for using this card. Welcome Bonus Delight Points of 1000 or 1500 are given if you spend Rs 10000 within 60 days from the day you get the card. Which you can redeem to buy lifestyle items.

- The biggest thing is that neither it has any joining fee nor annual fee is to be paid for it.

- If you are getting a card made in your name, then you can get two more add-on cards made in future.

- After making the card for yourself, you can add any other person in the family to it. It also does not incur any additional charges.