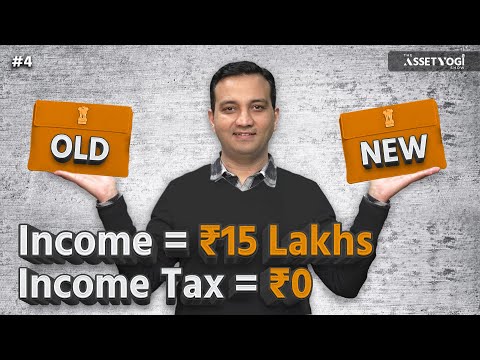

Income Tax Saving option: The salaried class invests up to Rs 1.5 lakh annually under Section 80C for income tax saving. But apart from this, if you want to invest then we are telling you about some more sections.

Income Tax Saving Option: The financial year is about to end. Everyone is planning to save as much tax as possible. To save income tax, salaried class invest under Section 80C of Income Tax. By investing in this, you get tax relief on income up to Rs 1.5 lakh. But if even after this your tax is due, then you can save your tax by investing under other sections of income tax. If you are also thinking about income tax saving options other than 80C, then we give you information about it.

NPS will save tax

If your limit under Section 80C has been exhausted and you want to save tax, then do not worry. You can save tax up to Rs 50,000 by investing in the National Pension Scheme (NPS). This investment is in addition to the limit of Rs 1.5 lakh under section 80C. This means that you can save tax on total income up to Rs 2 lakh.

Discount on health insurance

If you pay health insurance premium for your family, you can get tax exemption on it. Under Section 80D, you can invest up to Rs 25,000 on the health insurance premium of yourself, spouse and children. Apart from this, if the age of your parents is less than 60 years, then you can pay a premium of up to Rs 25,000 for health insurance. But if your parents are senior citizens then this limit is up to Rs 50,000.

Discount on health checkup

Do you know that you can also get tax exemption by getting a health checkup done? Under Section 80D, you can take deduction on the expenses incurred on investigation. Every year you can claim a maximum deduction of Rs 5,000. This amount comes within the limit of total deduction given under section 80D.

Rebate on interest on savings account

Under Section 80TTA, individual taxpayers and Hindu Undivided Families (HUFs) (to whom Section 80TTB is not applicable) can avail a maximum deduction of Rs 10,000 in a financial year on interest income from savings account opened in a bank, post office or co-operative society. One gets the benefit of tax deduction up to Rs.

Discount on donations

If you have donated funds to someone under Section 80G, then you can claim deduction on the donated amount. But it should be kept in mind that the amount of this donation should not be more than 10% of the total income. This deduction is also available on donations made for the renovation of temples, mosques and churches approved by the Central Government.

Also Read-

- Tax on FD: How much tax does the government collect from you on Fixed Deposit? FD investors should know

- Income Tax Department is alerting these taxpayers through email and SMS, know why?

- Fixed Deposits : Where will you get more benefits by investing money in SBI or BoB? clear up confusion

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com