Pakistan was placed on the grey list of the Paris-based Financial Action Task Force (FATF) at its June 29 plenary

Pakistan was placed on the grey list of the Paris-based Financial Action Task Force (FATF) at its June 29 plenary, a move that could have repercussions on its economy and the geopolitical calculus which governs the establishment’s relationship with ‘non-state actors’.

The External Affairs Ministry on Saturday lauded the move in a statement that said it hoped that this adverse decision would push Pakistan to confront terrorists operating out of its territory. This is not the first time that Pakistan has been grey-listed by the FATF, having been on it between 2012 and 2015.

Countries on the list are required to provide stricter guarantees while borrowing from international lenders like the International Monetary Fund (IMF) and also for receiving institutional aid from other countries. Here is a quick look at what the FATF does and what its grey-listing of Pakistan means for the country.

What is the FATF?

The FATF is an intergovernmental organisation founded in 1989 by G7 countries to combat illegal activities associated with the financial world order such as money laundering and terror financing. The Paris-based watchdog scrutinizes compliance with international norms regarding the sharing of financial information and cooperativeness of governments in tackling monetary flows in the underground economy.

The task force periodically issues general and country-specific recommendations for tackling money laundering, tax evasion and terror financing. It reviews the performance of countries and ranks them on the basis of their compliance in regulating the movement of money to blacklisted individuals or entities such as terrorist organisations and economic offenders, and banned organisations that are facing economic sanctions from UN member countries.

What is the FATF black list?

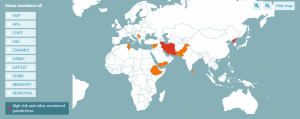

The FATF black list is shorthand for “Non-Cooperative Countries or Territories” (NCCTs). It has been issued since 2000 and lists countries that have been openly hostile and non-cooperative in the fight against money laundering and terror funding. Although the list did initially include offshore financial centres, the set of recommendations were soon amended to make tax havens compliant with all of the FATF’s criteria. As of now, the FATF black list comprises Iran and North Korea.

How is the FATF grey list different from the black list?

The grey list includes countries that are deemed to be lax in combating terror financing and money laundering. Pakistan was on this list previously between 2012 and 2015. But inaction over terror attacks on Indian targets by Lashkar-e-Taiba (LeT) and Jaish-e-Mohammed has prompted Pakistan’s return to the grey list.

While the black list represents countries which are hostile to external regulation of its economy, the grey list includes countries which continue to shield certain banned groups from greater institutional scrutiny and regulation. The countries which are presently on the grey list are Syria, Sri Lanka,Tunisia, Serbia, Yemen, Ethiopia and Iraq.

What are the restrictions placed on listed nations?

In addition to the negative picture painted of a country’s national institutions, laxity in dealing with groups banned by multilateral organisations reflects the government’s covert engagement with such entities. The most adverse impact will be on the economy, especially for countries reliant on foreign aid and development loans.

Apart from loans solicited from international lenders like the International Monetary Fund (IMF) or the Asian Development Bank (ADB), figuring on the FATF’s “Non-Cooperative Countries or Territories” list could see the migration of foreign capital and privately-owned foreign companies from those countries. Loans for infrastructure development could also be jeopardized if lenders are not confident of the security of their investments, and also a potential misappropriation of sanctioned funds for terrorism-related activities. Foreign banks with footprints spanning the globe, such as Citibank or Standard Chartered, could pull out, affecting the financial services sector in the country.

What are the implications for Pakistan?

The intention of placing nations on the FATF grey list is to squeeze their economic potential to meet the financing norms of foreign institutions, thereby enforcing compliance vis-à-vis regulating illicit wealth. However, many experts believe that the move will not result in a change in Pakistan’s position in tackling terror groups.

An article published in The Diplomat, which examines historical data, opines that grey-listing Pakistan will lead to a downgrade of its debt ratings, making it more difficult to tap into the global bond market. However, it goes on to say that as in the past, an adverse FATF verdict will only cause the government to tighten its purse strings, and will not significantly change its security calculus which is enmeshed with a web of non-state actors.

In the past, the support of China and Saudi Arabia had prevented Islamabad’s credit pipeline from running dry. However, with strategic allies indicating that they will not unconditionally back Pakistan in multilateral forums, this latest setback will test the country’s financial apparatus. The Trump administration has also repeatedly tried to coerce Pakistan into cracking down on political outfits which have links with armed groups.

Trump has repeatedly threatened to revoke Pakistan’s “major non-NATO ally” status and cut aid if does not act against terror groups operating from its territory. US aid for civilian and military programmes in the United States amounted to $526 million in 2017. The FATF grey-listing will further choke Pakistan’s ability to raise capital.