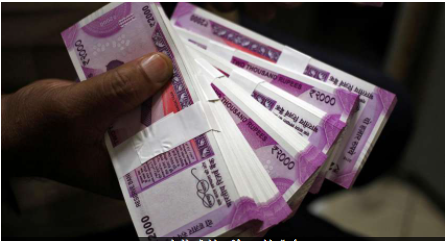

The central government has given affidavit in the Supreme Court that under the loan moratorium scheme, the government can waive compound interest on the loans of the customers who have taken loans of some Katagiri.

The central government can give big relief to the customers who take loans on housing loan, consumer loan, auto loan, personal loan and credit card. The Government has given affidavit in the Supreme Court that under the Loan Moratorium Scheme, the government can waive the compound interest on the loan of the customers who have taken loans of some Katagiri.

Banks will have to bear the burden of 6 lakh crores

In the affidavit given by the government, it has been said that the government has always been helping customers taking small loans. In such a situation, the facility of not taking compound interest from small loan holders till the time given under the loan moratorium scheme will be given. According to the information given by the government, due to this rebate given in interest, the banking system will have a burden of about 6 lakh crore rupees.

Also Read: Financial Crisis? … You can get low interest money in these 5 ways !!

You can get relief on these people

According to the information given, customers taking up to Rs 2 crore MSME loan, education loan, housing loan, consumer durable loan, credit card dues, auto loan, personal loan, and consumption loan can get exemption from compound interest. It is important to note that a large number of loan customers fall under this scope. In such a situation, if the government takes such a step, then a large number of borrowers will get relief.

They will not get any benefit

According to the information given by the government to the Supreme Court, any person or institution whose loan is above Rs 2 crore, will not get the benefit of the scheme of exemption in compound interest. They will have to pay full interest on their loan.