EPFO Passbook Lite: The reforms implemented by the EPFO will provide several benefits to subscribers. They will now be relieved of the hassle of logging into different portals. Passbook information will be readily available, complete control over PF transfers during job changes will be maintained, and claims will be approved faster.

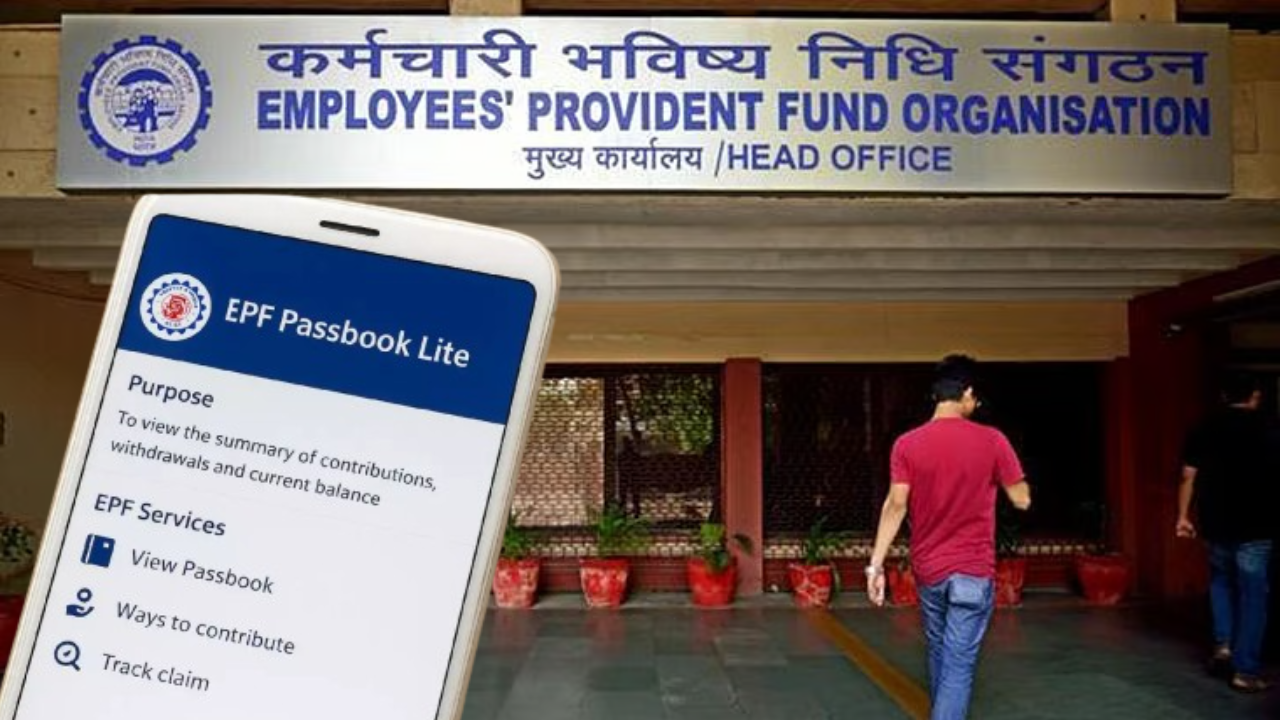

All services and account-related information will now be available through a single login on the EPFO portal. After the EPFO updated the portal, tasks that were previously time-consuming and complex will now become much easier and faster. Now, EPFO has also launched the most important feature, ‘Passbook Lite’. Earlier, PF members had to login to a separate passbook portal to make contributions, withdrawals, and check their balances.

Also Read: Maruti has Announced New Prices for all its Vehicles, Both Large and Small – See List Here

This process was often difficult due to password sync issues or technical issues.

Now, with Passbook Lite, members can quickly and easily access their account information. Balances and transaction summaries will be instantly visible. The old Passbook portal will still be available if they require more detailed information or a graphical view.

PF transfer made easy

EPFO reforms will now make it easier to transfer your PF account balance to a new employer upon changing jobs. Previously, this process was quite complicated. A transfer certificate, called Annexure K, was sent from the old employer to the new PF office. However, this document was not directly received by the member and often resulted in delays.

Under the new system, this Annexure K will now be available directly online. Members will be able to download it in PDF format from their portal. Furthermore, they will be able to track the transfer status online. This will increase transparency and create a permanent digital record that will be useful for future pension (EPS) calculations. Furthermore, the employee will be able to verify that their service history and balance have been correctly updated in the new account.

Claim will be received soon

EPFO has also simplified the approval process. Previously, services such as advances, refunds, transfers, or interest adjustments required approval from higher officials, which was time-consuming. Now, these powers have been extended to lower-level officials as well. This means that claim and transfer applications will be processed more quickly. This will not only speed up the process but also increase accountability.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com