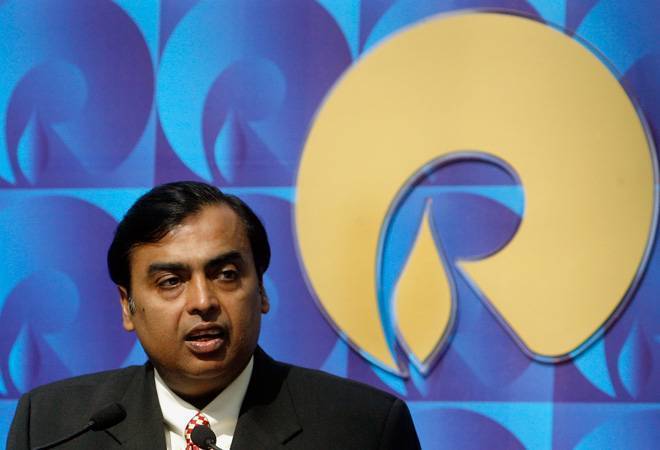

For the past 7-8 years, billionaire Mukesh Ambani and his large hydrocarbon exploration and production team, headed by veteran PMS Prasad, had been brooding over a vexed problem – the eroding natural gas production at Reliance Industries’ Krishna-Godavari (KG) Basin at the Andhra coast.

Finally, a government oversight panel, headed by directorate general of hydrocarbons (DGH), has approved its Rs 40,000 crore investment plan for developing three sets of discoveries in the KG D6 block. It is expected to revive the gas production in the region. RIL will invest about Rs 24,000 crore, while its partners BP and Niko Resources will contribute Rs 12,000 crore and Rs 4,000 crore, respectively. The production is expected to start from 2022, a company official said.

RIL had put together multiple revival plans but failed to recover the gas trapped inside the difficult deep-water terrain in the Bay of Bengal. It roped in British giant BP Plc by offering 30 per cent stake in all of its hydrocarbon assets in a $7-billion deal in 2011 to arrest the production slide. However, BP also failed to increase the production, which stands at 5 million standard cubic metres a day (mscmd) now vis-a-vis its peak of 60 mscmd in 2010. RIL had invested over $10 billion so far in the oil fields.

The companies plan to produce 30-35 mscmd of gas from KG D6 block, which consists of the R-Series, Satellites and D55. “In R-Series, the operator issued tender and received bids from sub-contractors. We will be able to start work from next year, since the favourable weather for working is available only for four months in a year in the east coast, between January and April. For the development of Satellites and D55, the approvals are in place. We will have to invite bids from sub-contractors to start the work,” says the official. RIL is also looking at the options to optimise the existing offshore infrastructure facilities in KG basin to reduce costs.

RIL and its partners had in 2016 withdrawn some of its arbitrations against the government to be eligible for the gas price revisions. The Modi government was unwilling to heed to RIL’s demand for arbitration in revising gas price since 2014. The government then revised the price to $5.6 per million British thermal unit (mBtu) from $4.2 for gas producers in India, except for RIL. RIL officials expect the withdrawal of arbitration will help the company to claim the premium price of gas.

In October 2017, the government had won the award in an arbitration case against RIL, which had disputed the quantum of penalty to be paid for not finishing the promised ‘work programme’ in four oil blocks, media reports suggest. It is not clear whether RIL paid the penalty.