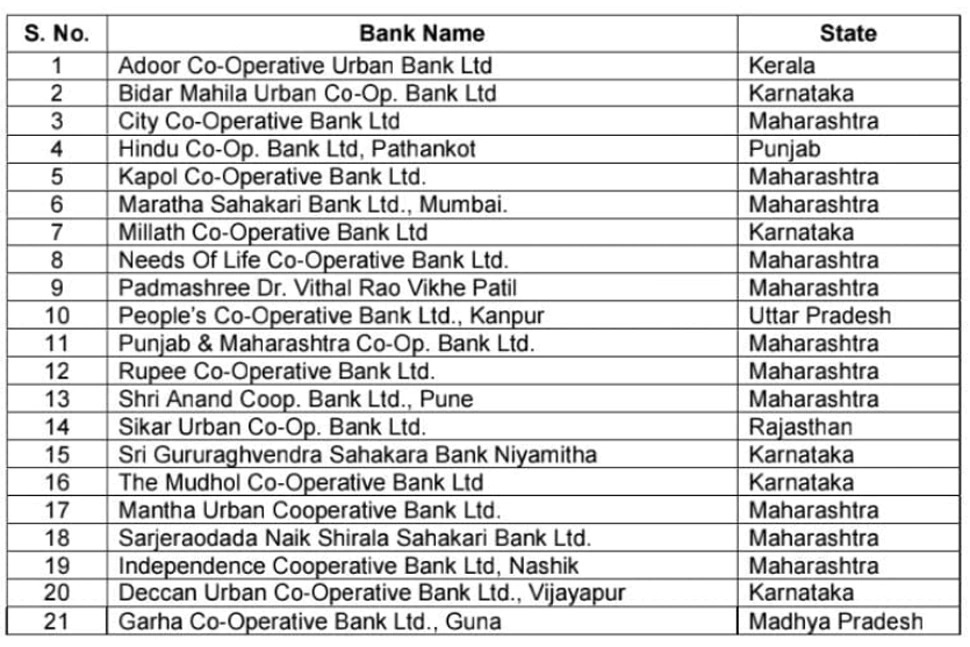

New Delhi: DICGC Act: Deposit Insurance and Credit Guarantee Corporation ie DICGC has given a big relief. DICGC has released the list of 21 banks whose account holders can get an amount up to Rs 5 lakh after the bank is closed. The special thing is that PMC Bank is also included in the list of these banks.

This is news of relief for the depositors of 20 more banks in trouble including PMC. Now the customers of these banks will get a claim of up to Rs 5 lakh within 90 days. But let us tell you that an amount of Rs 5 lakh will be given to the depositors of those banks which are on the moratorium of the Reserve Bank (RBI).

Government issued circular

The government notified the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act on 1 September 2021. That is, the depositors of the bank should get deposits up to Rs 5 lakh within 90 days of the ban on the functioning of a bank by the RBI. It is worth noting that the Finance Ministry had also issued a circular in this regard on August 27, 2021.

Customers will have to fill the claim form

In the 21 banks whose gist has been issued by DICGC, PMC bank account holders will also be paid. DICGC will pay the amount of deposit or maximum Rs 5 lakh. To get the insured deposit, the customers have to fill the claim form through their bank. Payment will be made to PMC bank account holders till December 29.

Bank has to give details

DICGC said, ‘For this amount, the form will have to be given to the DICGC on behalf of the banks by 15 October. After which the claim will be verified and then its processing will be done. The deposit will be paid with interest by 29 December 2021. The claim form will be available in the bank, in which the account number, branch and amount will have to be filled. The details of mobile number and e-mail will also have to be given in the claim form.

What is Deposit Insurance?

The banking system in India is strict and strong. The Reserve Bank closely monitors all the banks. In this sequence, for the safety of the customers, the Reserve Bank of India (RBI) gives insurance coverage on the money deposited in the bank. This coverage is provided by Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of RBI. According to DICGC, an insurance cover of Rs 5 lakh is available on deposits in banks.

These banks are under bank deposit insurance coverage

Let us tell you that all commercial and co-operative banks come under the ambit of bank deposit insurance coverage. Even if the branch of a foreign bank is in India, then DICGC gives insurance coverage on the amount deposited in it. Apart from this, all rural, local and regional banks are also under its purview.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com