If you too are planning to invest in Fixed Deposits (FDs), make sure you compare the interest rates of different banks and the rates within the bank for different tenors. Since the interest rate varies with different tenures and deposits.

If you too are planning to invest in Fixed Deposits (FDs), make sure you compare the interest rates of different banks and the rates within the bank for different tenors. Since the interest rate varies with different tenures and deposits. The maturity period of an FD account can range from seven days to ten years. The maturity period of short term fixed deposits can range from seven days to 12 months. Banks have different deposit interest rates, which are subject to fluctuate depending on the RBI’s key rates. It will also vary based on how long the FD is with the bank.

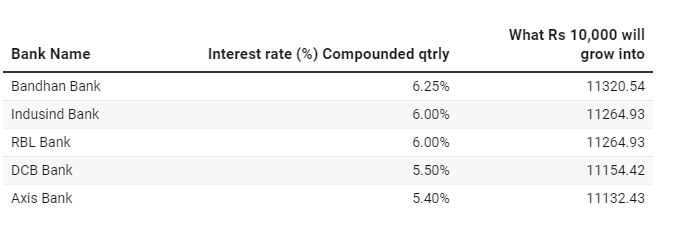

Other banks also increased FD interest rates

Recently SBI Bank has increased the interest rate on FDs of less than Rs 2 crore by ten basis points by the bank for a period of one year or less than two years. From January 15, 2022, this FD will now earn 5.1 percent (above 5 percent). Senior citizens will get 5.6 percent of the total income. At the same time, other banks like ICICI Bank, HDFC Bank and Axis Bank have also increased all FD interest rates.

Tax on FD

The thing to note here is that the interest earned on your FD will be kept under the head “Income from other sources” at the time of filing your return and is fully taxable. If your interest income from fixed deposits is less than Rs 40,000 per annum, banks will not deduct TDS. You have to submit Form 15G and Form 15H to the bank at the beginning of the financial year. Banks will not deduct TDS after paperwork.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com