SBI MCLR: The country’s largest government bank SBI (SBI) has increased the SCLR by 10 basis points. After this, the home-auto-personal loan of the customers is believed to be expensive.

SBI Hikes MCLR: If you are a State Bank of India (SBI) customer, then this news is for you. The largest public sector bank has increased the Marginal Cost of Lending Rate (MCLR) by 10 basis points, giving a jolt to the customers. According to the bank’s website, this change has become effective from April 15.

Loan EMI will increase

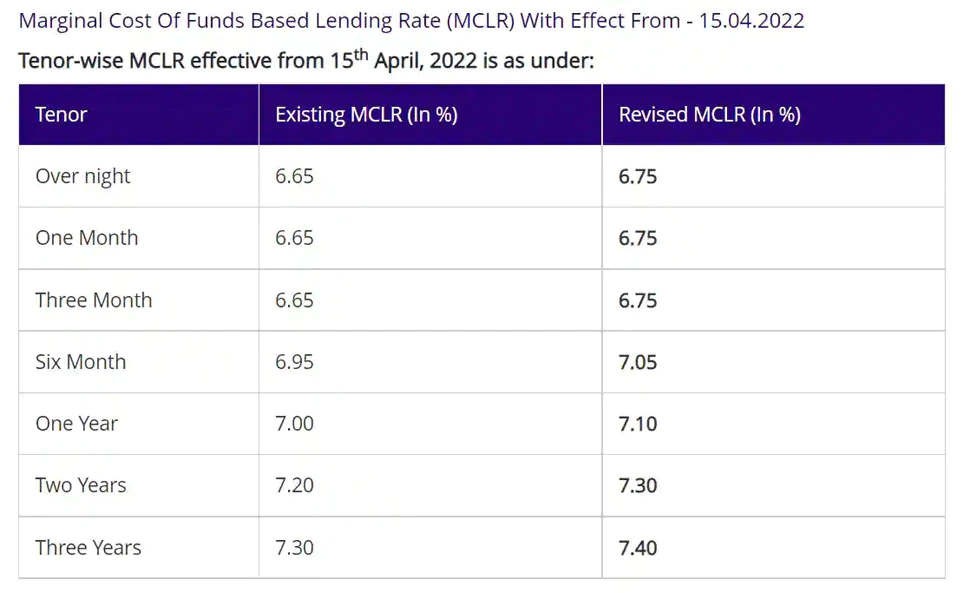

With the increase in MCLR, home loans, personal loans and auto loans will become expensive. This will have a direct impact on your EMI. According to SBI’s website, the rate of Marginal Cost Lending Rate (MCLR) for customers from overnight to three months will be 6.75% instead of 6.65%.

Here are the new rates

Apart from this, instead of 6.95 percent for 6 months, MCLR will be 7.05 percent. At the same time, 7.10% for one year MCLR, 7.30% for two years and 7.40 for three years.

What is MCLR?

The MCLR system was introduced by the Reserve Bank of India (RBI) in 2016. It is an internal benchmark for any financial institution. In the MCLR process, the minimum interest rate for the loan is fixed.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com