RBI Imposes Penalty: This Bank had offered higher interest rate than the interest rate given by SBI in violation of the instructions issued under SAF. No system was made by the bank for updation of KYC of account holders.

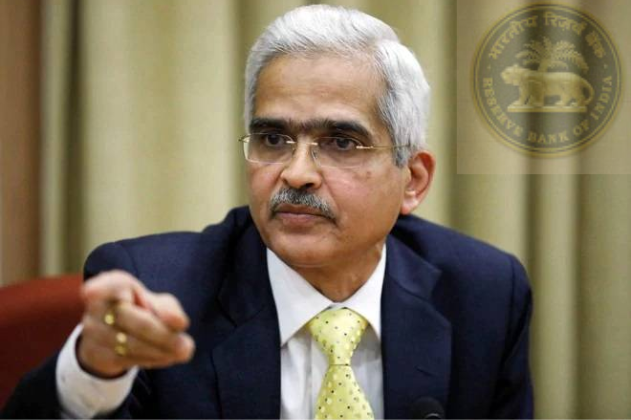

Reserve Bank of India: After imposing penalty on SBI recently, Reserve Bank of India (RBI) has now again imposed penalty on five co-operative banks. This penalty has been imposed by RBI for non-regulatory compliance. This time, the co-operative banks on which penalty has been imposed are SBPP Co-operative Bank Limited, The Sahyadri Co-operative Bank Limited, Rahimatpur Co-operative Bank Limited, The Gadhinglaj Urban Co-operative Bank Limited and The Kalyan Janata Co-operative Bank Limited.

Fine imposed for not following the rules

Reserve Bank imposed a fine of Rs 13 lakh on SBPP Co-operative Bank Limited, Kila Pardi, Gujarat for non-compliance of RBI instructions on ‘Interest Rate on Deposits’. A fine of Rs 6 lakh has been imposed on Sahyadri Co-operative Bank Limited, Mumbai. This penalty has been imposed on the bank for not following the rules of KYC and maintenance of deposit accounts. Sahyadri Co-operative Bank had not transferred the eligibility amount to the Depositor Education and Awareness Fund (DEA Fund). Apart from this, in violation of the instructions issued under SAF, a higher interest rate was offered than the interest rate given by SBI. No system was made by the bank for updation of KYC of account holders.

Fine of Rs 3 lakh for not following KYC rules

The Central Bank has imposed a fine of Rs 1 lakh on Rahimatpur Co-operative Bank Limited, Rahimatpur, District-Satara. This penalty was imposed by the Reserve Bank for not reviewing the in-operative bank account. The Gadhinglaj Urban Co-operative Bank Limited, Gadhinglaj has also been fined Rs 3 lakh for not following KYC standards. The Reserve Bank imposed a penalty of Rs 4.50 lakh on The Kalyan Janata Sahakari Bank Limited, Kalyan, Maharashtra for non-compliance with RBI orders on ‘interest rates on deposits’ and ‘maintenance of deposit accounts’.

SBI also fined

Earlier, a fine of crores of rupees was imposed by RBI on SBI and Indian Bank. After this, the Reserve Bank had imposed fine on three more co-operative banks. These included Saraswat Co-operative Bank Limited, Bassein Catholic Co-operative Bank Ltd and Rajkot Nagarik Sahakari Bank Ltd. A fine of Rs 1.3 crore was imposed on SBI, Rs 1.62 crore on Indian Bank and Rs 1 crore on Punjab and Sindh Bank.

Let us tell you that from time to time, the Central Bank imposes fine on banks for lapses in regulatory compliance. But it does not have any effect on the bank account holders. The bank does not impose any restrictions on account holders’ cash withdrawal or deposit.