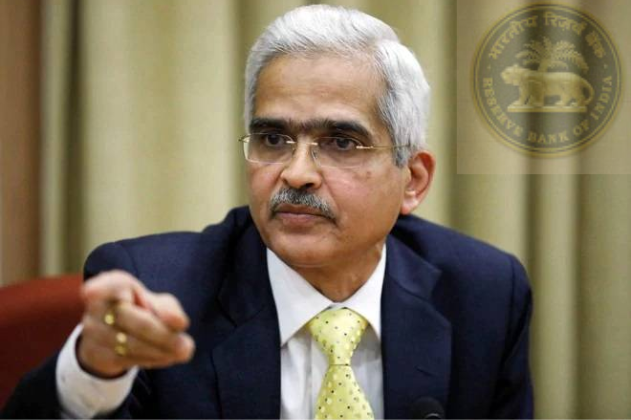

RBI Guidelines: Reserve Bank of India has issued some new guidelines for banks to collect penalty on loan accounts. Know which rules they will have to follow from now on. Let us know about it in detail.

The Reserve Bank of India has announced new guidelines for banks and financial institutions. Under this, instructions have been issued regarding many rules regarding penalty in loan accounts.

RBI has said that banks and regulated entities should not use the option of penalty on loan accounts to increase their revenue.

Reserve Bank made rules – know what they are

The Reserve Bank of India has issued a circular under which it has told the banks how they can follow the rules of penalty on loan accounts. This decision has been taken by RBI (Reserve Bank of India) after many recent developments in which banks are adding penalty to the interest being charged on the

loan and on the basis of this, they are charging interest on top of the interest from the loan holders. RBI has announced new guidelines by which in case of loan default, the penalty charged by banks will be seen as penal charge and not as penal interest.

RBI gave information by posting on

Reserve Bank of India has given information about these changed rules on its X (formerly Twitter) platform and has included the RBI circular in this X post. Complete information about these changed guidelines can be obtained by visiting this.

When will these new guidelines come into effect?

According to the circular of RBI (Reserve Bank of India), these new guidelines will come into effect from next year i.e. 1 January 2024. All commercial banks including small finance banks, local area banks and regional rural banks will come under the purview of this rule and this rule will also apply to payment banks.

All primary urban co-operative banks, NBFCs and housing finance companies and all India financial institutions like Exim Bank, NABARD, NHB, SIDBI and NaBFID will also come under the purview of these guidelines of RBI.