Postal Life Insurance Bond can be easily obtained from Digital Locker. Let’s know its special steps

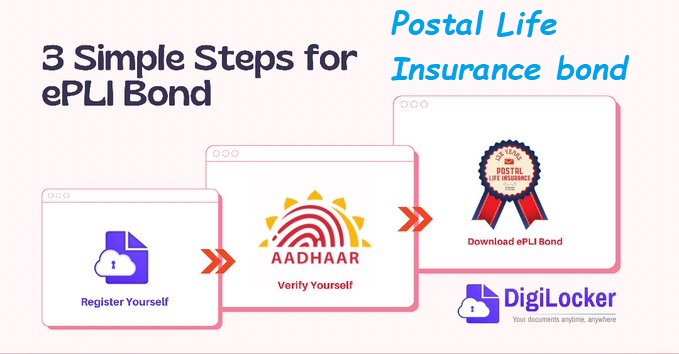

Postal Life Insurance bond from digilocker – If you also want to apply for the digital version of the postal life insurance policy- ePLI bond issued by the Department of Posts, then these steps are for you. In fact, the Department of Posts recently released a digital version of its ePLI bond. Through this, the subscribers will have access to this policy through DigiLocker. Postal Life Insurance has shared three simple steps by tweeting, so that people can easily download EPLI bond, along with registering by following these steps. Let’s know these three easy steps to register.

Three easy steps to get Postal Life Insurance Bond from Digital Locker –

- First, register by downloading the Digital Locker app from the App Store

- Log in using Aadhar Card

- Enter policy number, name and date of birth and download EPLI bond

Three simple steps to get Postal Life Insurance bond from digilocker.

1. Register by downloading digilocker app from App Store

2. Log in using Aadhaar

3. Enter policy number, name and Date of birth and download the ePLI Bond. @IndiaPostOffice #ePLIBond pic.twitter.com/9kEiXwgieL— Postal Life Insurance (@postalinsurance) October 15, 2021

By following these three steps, you can also get the digital version of the postal life insurance policy – ePI bond. Along with this, its digital copy will be considered as a valid document for all your transactions. Notably, the EPLI bond will be available in collaboration with DigiLocker. It has been developed by the National e-Operations Division under the Ministry of Electronics and IT.

What is life insurance policy?

Post offices across the country give many policies to their customers. One of those policies is EPLI Life Insurance Policy. This policy is one of the oldest policies in the country. PLI (Postal Life Policy) was introduced on 1 February 1884 during the British rule in India. Let us tell you that many insurance schemes are run by the government across the country, one of those schemes is PLI. A life insurance plan is a contract between the insured and the insurance company, in which the insurance company gives a certain amount to the beneficiary in case of any untoward incident or death of the insured during the term of the insurance plan. In return, the policyholder promises to pay a fixed amount either in lump sum or one by one as premium.