Anyone can plan an investment under this scheme of Post Office. Even a minor can open an account in it. Any minor aged 10 years can open an account with the help of his parents.

If you are considering investing in government schemes without taking risk in the stock market or mutual funds and are looking for an investment option like SIP, in which the risk is negligible, then Post Office’s Recurring Deposit can prove to be right for you. You can start investing in this scheme with just Rs 100. There is no maximum limit.

Anyone can plan an investment under the Post Office RD scheme. Even a minor can open an account in it. Any minor aged 10 years can open an account with the help of his parents. After completing 18 years, the minor will have to fill a new KYC and fresh opening form. This account can be opened through mobile banking or e-banking facility. Under this scheme, 6.7 percent interest is available.

Rules for depositing installments every month

The first monthly deposit will be made at the time of opening the account and such deposit amount will be equal to the denomination of the account. If the account is opened before the sixteenth day of the calendar month, then the next deposit amount equal to the first deposit amount will be made till the 15th day of every month and if the account is opened after the 16th day and the last working day of the calendar month, then the deposit will be made between the 16th day and the last working day of every month.

Five years maturity

If you open an account under the RD scheme, then the maturity of your account will be completed in 5 years. If you want, you can extend it by 5 more years. Apart from this, if you want to close it midway, then you can close it after 3 years of opening the account. If the account holder dies, the nominee can claim it. Also, if the nominee wishes, he can continue it.

Tax rules on RD

Investment in post office RD is eligible for tax deduction up to ₹1.5 lakh per annum under section 80C of the Income Tax Act, 1961. However, TDS rules apply on interest income, which means you will have to pay TDS. If you are earning more than 10 thousand rupees annually from interest, then you will have to pay 10 percent tax, but if you are unable to provide PAN, then this tax will be applicable at 20 percent.

Loan benefits are also available

After the account is active for at least 1 year and depositing in the account for 12 months, the depositor can take a loan of up to 50 percent of the amount deposited in the account. If you wish, you can repay the loan in lump sum or in monthly installments. As per the rules of the scheme, in addition to the interest rate applicable on the loan account, an extra 2% simple interest will have to be paid. If the loan is not paid till the account is closed, then the outstanding amount will be recovered from the account deposited on account closure.

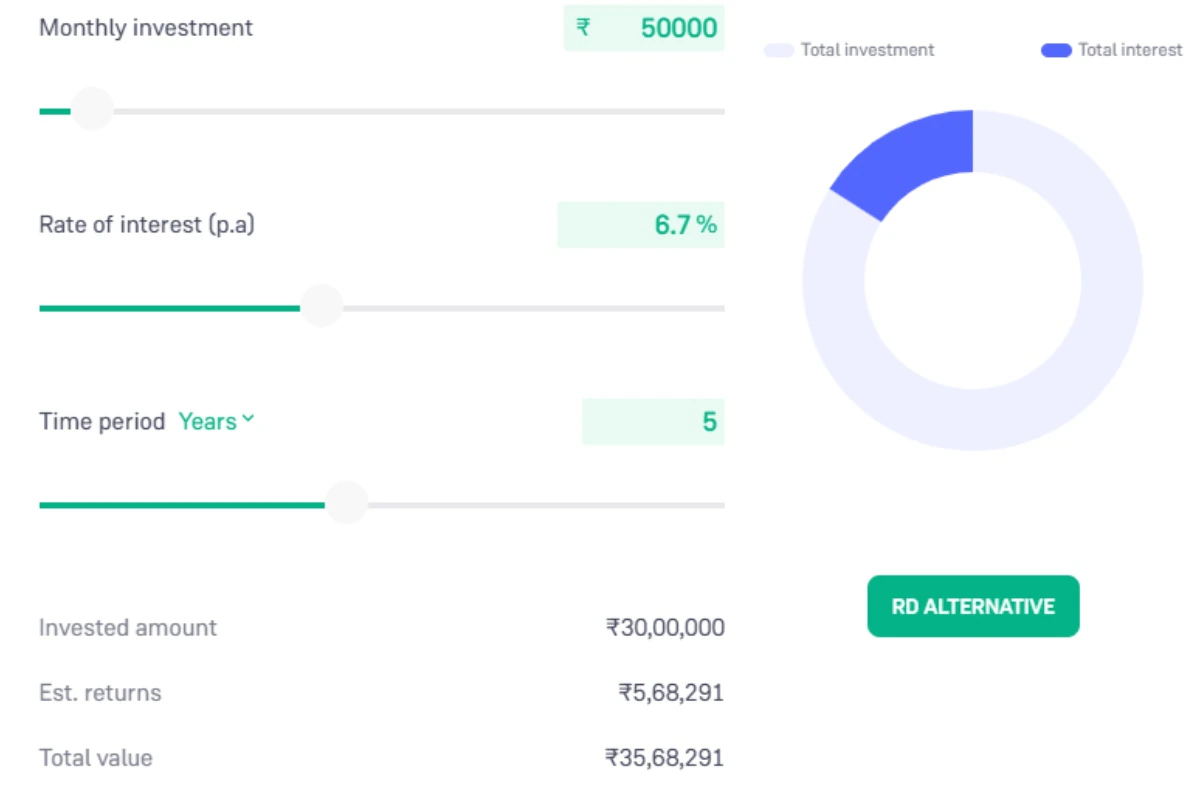

How will you get the benefit of 35 lakhs?

If you invest 50 thousand rupees every month in this scheme of the post office, then in 5 years you will deposit 30 lakh rupees. Apart from this, on the basis of 6.7 percent annual interest, you can earn Rs 5,68,291 in 5 years, which will come under TDC deduction. In such a situation, you will get a total of Rs 35,68,291 in five years.

Most Read Articles:

- Post Office Scheme: Deposit once in Post Office and get guaranteed income of Rs 20,000 every month

- 8th Pay Commission: Good news! Salary and pension of central employees and pensioners may increase by 30-34%, check update

- Credit Card Link UPI: Link your credit card to UPI from home, know step-by-step guide

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com