Post Office Saving Schemes: Post Office Saving Schemes have always been a better investment option for short and long term. The interest rates in these schemes are fixed on a quarterly basis, along with safety and guaranteed returns. These include popular schemes like Sukanya Samriddhi Yojana, Senior Citizen Savings Scheme, National Saving Certificate and Kisan Vikas Patra.

New Delhi: Post Office Saving Schemes have always been the choice of people and a great option of investment. This is because of better returns and security of money. Because the investment made in the post office savings scheme is absolutely safe and the interest rates in these schemes are fixed on a quarterly basis. Let us know about the best post office savings schemes in which you can get good returns by investing.

Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana is a brilliant scheme of the post office which has been made for the better future of daughters. This account can be opened in the name of a girl child below the age of 10 years in a post office or an authorized bank. In this scheme, an annual interest of 7.6 percent is available as compared to fixed deposits, as well as the benefit of income tax benefits can also be availed.

Senior Citizen Savings Scheme

The best scheme of the post office for guaranteed income for senior citizens is the Senior Citizen Savings Scheme. The rate of interest in this scheme is 7.4% per annum. The maturity time of the scheme is 5 years and a maximum investment of Rs 15 lakh can be made in it. A lump sum amount has to be paid in this scheme. Under the Senior Citizen Savings Scheme, people of 60 years of age or above can open an account, with the account being extended for another three years even after maturity.

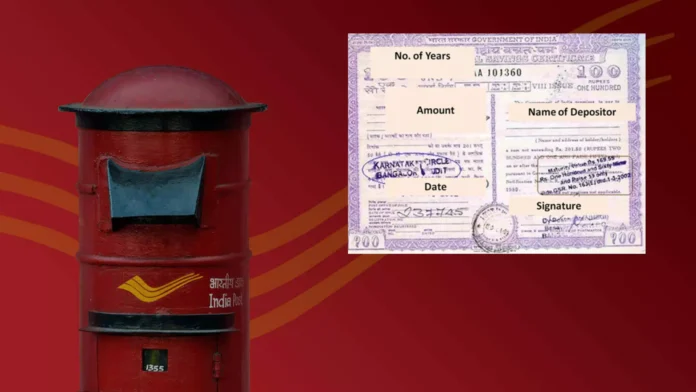

National savings certificate

In this post office savings scheme, an interest of 6.8 percent is available annually. The National Savings Certificate Scheme has a guaranteed return and has a tenure of 5 years. A minimum amount of Rs 100 can be invested in this account while there is no maximum limit. In the National Saving Scheme, tax exemption is available under section 80C of the Income Tax Act.

Kisan Vikas Patra

Guaranteed returns are also available on the Kisan Vikas Patra of the post office. On investing in this scheme, customers get 6.9 percent interest annually. The maturity period of the plan is 14 months. The minimum amount of investment in this is 1000 while there is no maximum limit.