Home Loan: At least 16 banks and housing finance companies are offering home loans of up to Rs 75 lakh at an interest rate of less than 7 percent.

Coronavirus made people understand how important it is to have their own home. Even when people did not have jobs, they had to pay rent. In such a situation, people felt that if they had their own house, at least one would not have to worry about rent even in difficult times. Due to this, people are showing more interest in taking their home since the pandemic. Most of the people take a home loan to get a house. So if you are also planning to take a house, then today we will tell you how much interest rate and EMI will be charged.

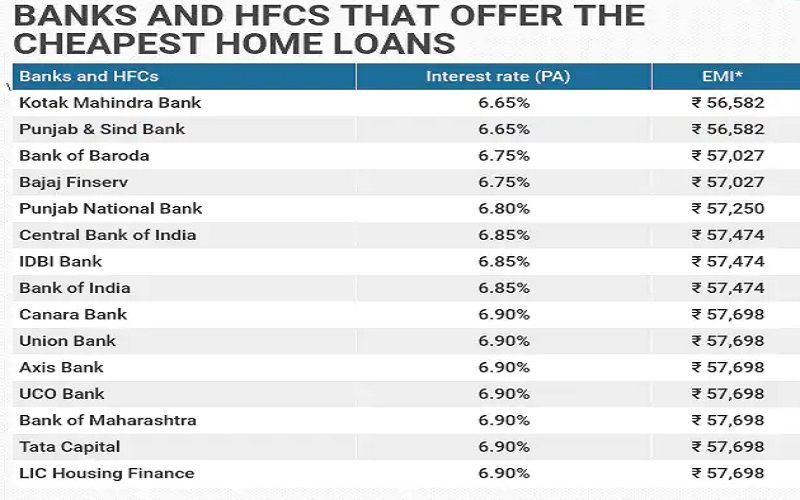

Know the interest rates of these banks There are

many banks which are ready to offer you loans even at low interest rates. According to data from Bankbazaar.com, at least 16 banks and housing finance companies offer home loans of up to Rs 75 lakh at interest rates below 7 per cent. Among these lenders, private sector bank Kotak Mahindra Bank and state-owned Punjab & Sind Bank offer the cheapest home loans with interest rates starting from 6.65 per cent.

If you are also planning to buy your home, then see here the complete information about interest rates, EMI…

Home loan rates at 6.49-6.95 percent

According to BankBazaar , in September 2019, the lowest home loan rates were in the region of 8.40 percent. Now, the lowest home loan rates in July 2021 are in the range of 6.49-6.95 per cent. The rate cut is due to the introduction of RLLR as well as a cumulative 115 basis point rate by the Reserve Bank of India (RBI) in March and May 2020.

In fact, the decision of the Reserve Bank of India to keep the repo rate unchanged at a low of 4% for more than a year has contributed to many banks reducing their fixed deposit interest rates, thereby demoralizing investors. However, this low repo trend has prompted many banks to reduce their floating home loan interest rates to a decade low, especially since October 2019 when the central bank asked all banks to externalize their loans. Was instructed to benchmark from

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com