A High Authority Committee of SEBI has told on Wednesday that due to technical problems, the ‘refund portal’ for PACL investors will be ‘stalled’ for five days. This committee is looking into the process of returning the money of PACL investors.

PACL Chit Fund Refund Latest News 2022: PACL investors have started getting a chance to amend the refund application from November 1, 2022, but due to technical glitches, they will not be able to do any work for the next five days. A High Authority Committee of the Securities and Exchange Board of India has told on Wednesday that due to technical difficulties, the ‘refund portal’ for PACL investors will be ‘stalled’ for five days. This committee is looking into the process of returning the money of PACL investors.

The committee, headed by retired Justice RM Lodha, is looking into the process of returning the money to the investors through disposal of properties after verifying them. The committee has already started the process of refund in several phases. Let us tell you that SEBI had formed this committee in 2016 after the order of the Supreme Court.

The committee had prepared a ‘facility’ in October for investors with claims up to Rs 15,000. This facility was for those investors whose applications had some shortcomings. These investors can correct these deficiencies on the sebipaclrefund.co.in portal. Starting from November 1, 2022, this facility was made available till January 31, 2023. According to a statement released on SEBI’s website, “due to technical difficulties, applications will not be able to be submitted again on the refund portal for five days.”

What is the whole matter?

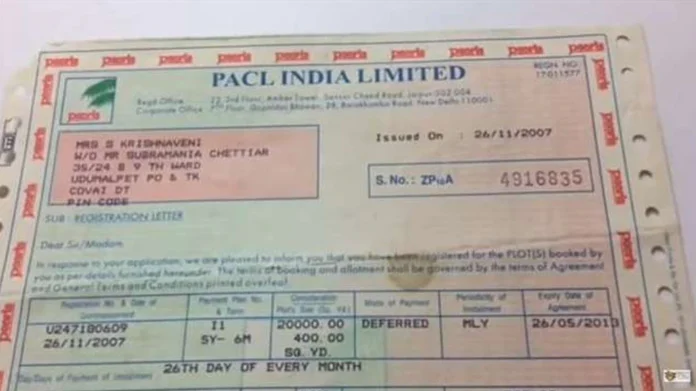

PACL, also known as Pearl Group, raised funds in the name of agriculture and real estate business. SEBI had found that the company had raised over Rs 60,000 crore through an illegal Collective Investment Scheme (CIS) over a period of 18 years. It is alleged that Pearls offered attractive interest rates to investors to raise money, while paying hefty commissions to agents. In such a situation, in the greed of interest and commission, a large number of people put their money.

Market regulator SEBI had in December 2015 ordered attachment of all assets of PACL and its nine promoters, including directors, who were failing to refund investors’ money.