It is necessary to have a good CIBIL score to get a loan and credit card from the bank.

CIBIL score is made according to credit history of 24 months

Mobile wallet app Paytm (Paytm) has launched the Cibil score checking facility. Now you will be able to check your CIBIL score for free with the help of the Paytm app from home. Now you can see your credit report in the users details. Through this, you will be able to view credit report of active credit card and loan account. We are telling you how you can check your CIBIL score from Paytm app.

This is how you can check your credit or CIBIL score

For this, first you have to login to the Paytm app. After this, more icon has to be tapped on the home screen of this app.

After tapping on this icon, you have to fill the PAN card number and date of birth. Submit it after this.

If you are a new user, an OTP will also be sent for profile verification.

After putting it your CIBIL score will be in front of you.

Here, apart from seeing your credit score, you will also get many important information related to it.

Also Read: Keep these things in mind if you want to take a loan, you will get loan easily

What is CIBIL score?

The CIBIL score provides information about past debts. Therefore, it is necessary to have a good CIBIL score to get a loan and credit card from the bank. Paying a regular loan keeps the credit score good. The CIBIL score is between 300 and 900 points. If the score is 750 points or more, then getting a loan is easy. The better the CIBIL score, the easier it is to get a loan. The CIBIL score is calculated according to the credit history of 24 months.

What is the benefit of keeping the CIBIL score correct?

The CIBIL score provides information about past debts. Therefore, it is necessary to have a good CIBIL score to get a loan and credit card from the bank. Paying a regular loan keeps the credit score good. The better the CIBIL score, the easier it is to get a loan.

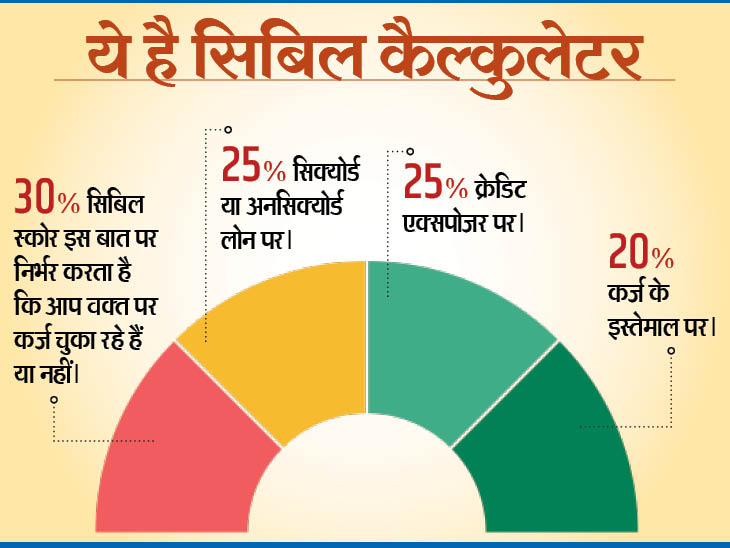

How much does the CIBIL score depend on?