In the past month, Vodafone Idea Ltd’s shares jumped by 20% twice, in two consecutive trading sessions on both occasions. The first was when the Telecom Regulatory Authority of India suggested it might rethink the abolition of interconnection usage charge (IUC) from January 2020. Then again, last week, in the backdrop of rumours of an increase in tariffs by Reliance Jio Infocomm Ltd.

But these hopes have come to nought. If IUC stays, it will certainly be a positive for Vodafone Idea, but a mere band-aid in the overall scheme of things.

The news, which sent the company’s shares down 16% in the past two trading sessions, and shares of Bharti Airtel Ltd by about 6% earlier this week, was Reliance Jio’s announcement of a sharp increase in the subsidy offered on its 4G feature phone. JioPhones will now be available for an upfront cost of ₹699, compared to ₹1,095 in the previous scheme.

This offers Reliance Jio a much better chance to capture the low-end of incumbents’ subscriber base. Jio also offers an unlimited voice plan for as low as ₹49 per month. Currently only about one-fifth of the company’s subscriber base uses the JioPhone.

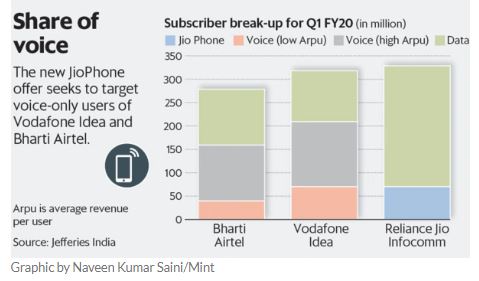

Unlike smartphone users, who shifted in droves to Jio’s network, feature phone users of Vodafone Idea and Airtel haven’t had the same opportunity, given the cost advantage of 2G handsets vis-à-vis 4G devices. “The offer clearly targets non-data/2G subscribers of Bharti Airtel and Vodafone Idea, which stand at 42% and 52%, respectively,” analysts at Emkay Global Financial Services Ltd said in a note. As such, a hitherto protected segment for the incumbents now stands the risk of being captured by Jio.

“Jio’s average monthly subscriber additions of around 8 million per month can be expected to rise as a result of the higher subsidy; maybe to 11-12 million,” said an analyst at a domestic institutional brokerage firm, requesting anonymity. With the company expected to end the September quarter with a subscriber base of 350 million, and assuming monthly additions of 12 million, Jio may well reach the 500 million subscriber mark within a year from now, to have over 50% market share.

Apart from accelerating its market share gains, what this also means is that Vodafone Idea’s and Bharti Airtel’s revenues from IUC can drop materially. After all, users at the low-end mostly receive calls and earn IUC for incumbents. If more of them start using the subsidized JioPhone, the above-mentioned traffic imbalance may reverse, and hurt incumbents.

Moreover, given Jio’s continued aggression with regards to subscriber acquisition, it seems unlikely that a tariff hike is anywhere around the corner.