New Wage Code: Even if the in-hand salary is said to be reduced after the new labor law is implemented. But, there will definitely be other benefits from this. The special thing is that even a working person can become a millionaire at the time of retirement. But, for that the calculation of EPF has to be taken care of.

New Wage Code latest news in Hindi: New labor laws are yet to be implemented. But, for the last 2 years, their discussion is in full swing. A total of four labor codes will be implemented in the country. Most of the states have given their consent on the draft rules. Labor Minister Bhupendra Yadav has expressed hope that the new labor laws will be implemented soon. Preparations have been completed by the Labor Ministry. The job profession will be benefited the most if the new wage code is implemented. More corpus will be deposited in his provident fund. According to experts, even though there will be some reduction in the monthly in-hand salary, but more retirement funds will be collected through EPF. Your EPF account alone can make you a millionaire.

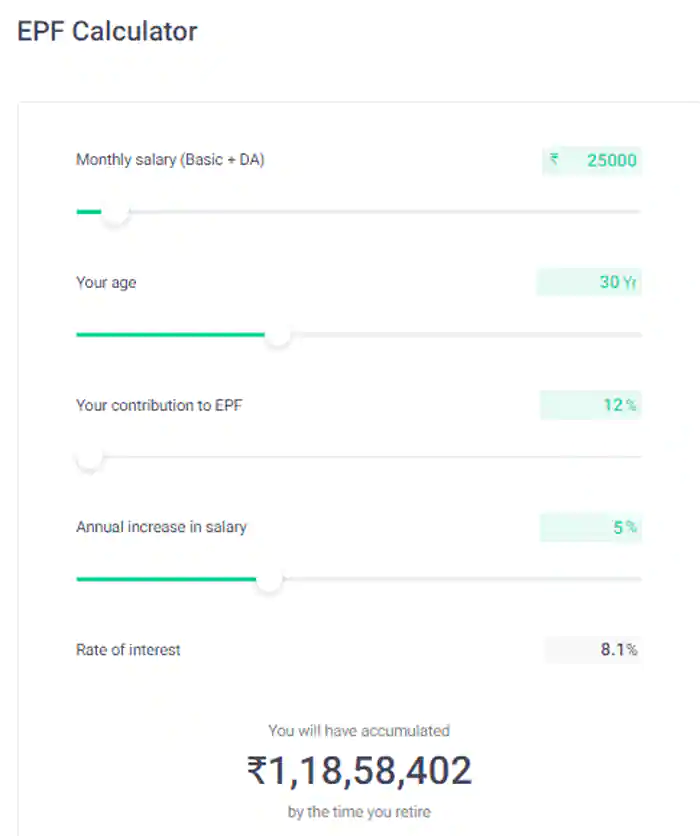

Calculation of New Wage Code

When the New Wage Code is implemented, let us assume that the basic salary of an employee is Rs 25,000 per month. In such a situation, the total amount of EPF with him on retirement will be Rs 1,18,58,402. An annual increment of 5 percent has also been kept in this calculation, due to which the EPF fund will increase further.

If we look at the present conditions, then the monthly salary of an employee is Rs 50,000 and the basic salary is Rs 15,000, then the amount of PF on retirement will be Rs 64,62,867.

What is cost to company?

The expenditure incurred by a company on its employee is CTC. This is the complete salary package of the employee. CTC includes monthly basic pay, allowances, reimbursement. At the same time, products like Gratuity, Annual Variable Pay, Annual Bonus are included on an annual basis. The amount of CTC is never equal to the take home salary of the employee. There are many components in CTC so it is different. CTC = Gross Salary + PF + Gratuity

Basic salary

Basic salary is the base income of an employee. It is fixed on the basis of the level of all the employees. It is according to the post of the employee and the industry in which he is working.

Gross salary

- PF Calculator New Wage Code: The salary that is made by adding basic pay and allowances without deducting tax is called gross salary. This includes bonus, overtime pay, holiday pay and other allowances.

- Gross Salary = Basic Salary+HRA+Other Allowances

Net salary

- Net salary is also known as take home salary. The salary that is made after deducting tax is called net income.

- Net Salary = Basic Salary + HRA + Allowances – Income Tax – EPF – Professional Tax

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com