As we are at the fag-end of March quarter earnings season, experts expect some volatility in the week ahead and also some stock-specific action

Benchmark indices saw major weekly correction for the first time after the spectacular run of more than 800 points on the Nifty started from 2018 closing low of 9,998 touched on March 23. It was turned out to be a profit booking point for investors who are still betting on earnings recovery from current financial year 2018-19 onwards.

Uncertainty over the formation of government in Karnataka, rising crude oil prices, weaker rupee, US-China trade war tensions and weak earnings hit investor sentiment.

The Sensex and Nifty dropped nearly 2 percent each while BSE Midcap and Smallcap indices shed 2.7 percent each for the week gone by. Among sectors except FMCG (up 1.14 percent), there was sharp correction in Auto (down 3.6 percent), PSU Bank (6.5 percent), Private Bank (2 percent), Infra (3.7 percent), Metal (3.3 percent), Pharma (2.8 percent), Energy (3.7 percent) and Realty (2 percent) indices.

Apart from expected volatility due to state elections going ahead and ongoing US-China trade war woes, rising crude oil prices and weaker rupee are major risks for the market currently, experts said.

As we are at the fag-end of March quarter earnings season, experts expect some volatility in the week ahead and also expect some stock-specific action.

Higher crude oil prices and the rupee’s weakness will continue to act as dampener putting lot of pressure on the fiscal deficit and bond yields in the short term, Vikas Jain, Senior Research Analyst, Reliance Securities said.

So he further said one would have to be very selective in the approach towards individual stocks from the current levels as lot of macros are changing with respect to higher crude prices and rupee weakness against the greenback.

With lack of any fresh positive triggers globally and on the domestic bourses, Jayant Manglik, President, Religare Broking expects the markets to consolidate in the near term. However, the ongoing correction should be considered as good opportunity for long-term investors to accumulate fundamentally sound stocks on dips, he advised.

Ajay Bodke, CEO and Chief Portfolio Manager PMS, Prabhudas Lilladher said investors are advised to stick to companies with stable, steady and visible earnings growth in sectors such as retail-focussed private banks, FMCG, retail and automobiles.

“Investors need to tread with caution in sectors such as aviation, logistics, OMCs and tyres. Although a falling rupee and expectation of strong near-term demand has propelled many mid-cap IT companies to new highs their valuations appear stretched. Headwinds in pharma sector would continue to cap the upside. Corporate focused banks would continue to reel under high provisioning requirements for atleast 2 more quarters and are best avoided,” he added. Manglik said traders should strictly avoid overleveraged positions.

Here are 10 key factors that will keep traders busy next week:

Earnings

As we are near the end of March quarter earnings season, around 1,800 companies will announce their numbers by end of this month which include results of more than 800 firms in the coming week.

Earnings so far have not been on the expected lines barring consumer, technology and auto companies. PSU Banks and other midcap numbers were not encouraging, which was one of major reasons for market correction last week.

Important corporate earnings, which are scheduled in the next week, include Colgate Palmolive and DLF numbers which will be announced on Monday while PSU bank major SBI, Cipla, Dr Reddy’s Labs, oil retailers IOC & HPCL and Bharat Forge will declare results on Tuesday.

Grasim, Tata Motors, Indiabulls Housing Finance and Motherson Sumi will come out with their earnings on Wednesday. GAIL and United Spirits will announce results on Thursday while Tech Mahindra, Sun Pharma, IDBI Bank, Bank of Baroda, Cadila Healthcare, Karur Vysya Bank and PFC will come out with results on Friday.

SBI

PSU banks so far, especially after the change in RBI regulations related to non-performing assets, posted dismal performance for the quarter ended March 2018. Punjab National Bank, Dena Bank, Central Bank of India, Canara Bank, Syndicate Bank, Union Bank of India and Oriental Bank of Commerce together reported loss of over Rs 28,000 crore for the March quarter.

Now all eyes are on the country’s largest lender State Bank of India, which will report earnings on coming Tuesday, followed by Bank of Baroda on Friday.

Prabhudas Lilladher said SBI would have a higher impact from revised RBI guidelines and should report another quarter of losses on higher provisions led by high expected slippages of Rs 18,860 crore but lower than Q3FY18 slippage of Rs 26,800 crore, but should see investment depreciation reversal on RBI guidelines, reducing losses.

Loan growth should remain muted on merged like to like basis with margin pressure, it added.

According the brokerage house, loss for the quarter could be around Rs 1,245.6 crore against loss of Rs 3,441 crore in Q4FY17 and Rs 2,416.4 crore in Q3FY18 while HDFC Securities expects loss around Rs 2,390 crore, KR Choksey sees around Rs 2,296 crore, Sharekhan around Rs 1,199 crore and Edelweiss around Rs 1,073 crore.

HDFC Securities said key monitorables would be asset quality movement and slippages from other stressed assets; comments on resolutions, growth and margins; and utilisation of RBI’s dispensation for provisions on NCLT exposures and MTM losses.

Tata Motors

Tata Motors, the owner of luxury car brand Jaguar and Land Rover, is expected to report good set of earnings on sequential basis due to favourable base but year-on-year numbers are expected to be weak.

According to Edelweiss Securities, consolidated profit is likely to be around Rs 3,684.8 crore (an increase of 237 percent QoQ but decline of 15 percent YoY) while revenue growth is expected to be strong at 16.7 percent YoY and 21.5 percent QoQ on good volume growth.

“We expect consolidated operating margins to improve sequentially by 130bps to 12.8 percent YoY driven by operating leverage benefits in India and improving performance in JLR,” the research house said.

Tata Motors’ standalone sales volumes in March quarter grew by 35 percent YoY and 19.1 percent QoQ while JLR showed volume growth of 15.7 percent QoQ and degrowth of 2.6 percent YoY.

“Standalone margins are expected to improve 600bps YoY & 150bps QoQ. JLR’s margins are likely to be at 13.5 percent, lower 100bps YoY, owing to expectations of an unfavourable product mix,” Prabhudas Lilladher said, which expects profit growth of 309.7 percent QoQ (4.7 percent YoY) and revenue growth of 24.7 percent QoQ (19.8 percent YoY).

Karnataka Election

One of the reasons for market correction last week was the uncertainty over formation of government in Karnataka after not a single party got the clear majority. The voting took place for 222 constituencies on May 12 and counting on May 15.

BJP won 104 seats in the 2018 Assembly elections as compared to 40 in 2013, Congress 78 seats and JD (S) got 38 seats. BJP as well as Congress have been saying that they have enough seats to prove majority.

To finalise the formation of government, the Supreme Court on Friday asked parties to prove majority through floor test on Saturday (May 19).

The floor test did not take place on Saturday as BJP’s BS Yeddyurappa announced his decision to resign without facing a trust vote.

Now, JD(S) state chief HD Kumaraswamy with support from the Congress will form the government. This newly formed alliance has claimed support of 117 MLAs in the 224-member House.

Ajay Bodke, CEO and Chief Portfolio Manager PMS, Prabhudas Lilladher feels if the BJP were to win the floor test markets are likely to move sideways and make an attempt to consolidate. However, if the BJP were to lose then the sharp correction that is underway is likely to gather momentum, he said.

Crude and Rupee

Crude oil prices have been trading at multi-year highs while the Indian rupee has been hitting fresh 16-month highs, which both are major risks for India and equity markets.

“Indian markets are right now more focused on the adverse fallout of surging global crude oil prices on India’s macroeconomic fundamentals,” Ajay Bodke of Prabhudas Lilladher said.

Brent crude futures, the international benchmark for oil prices, hit $80 a barrel in the passing week for the first time since November 2014 but failed to sustain above that levels. It rose 1.7 percent to $78.51 a dollar in the week gone by due to geopolitical tensions, OPEC-led pact to cut supplies, strong global demand, falling Venezuelan production and looming US sanctions on Iran.

Generally higher crude oil price creates major fiscal imbalance for the country like India which imports more than 80 percent of oil requirement and increase inflationary pressure. It also impacts earnings of oil marketing companies if they fail to pass on to consumers.

“India’s net oil imports equal about 3.5 percent of GDP. That means more expensive oil can impact everything from inflation and growth to the budget balance and, potentially, Reserve Bank of India policy,” Stewart & Mackertich said.

Meanwhile, the rupee, which ended the week at 68.01 to the US dollar against previous week closing of 67.33 (down 32 paise WoW), is also expected to create inflationary pressure.

So both factors will be keenly watched by the Reserve Bank of India ahead of Monetary Policy Committee meeting outcome on June 6, 2018.

Technical & F&O

The 50-share NSE Nifty closed below psychological 10,600 levels after hitting the highest level of 10,929.20 intraday during the week gone by, which hit traders’ sentiment.

Now technical experts expect the market to consolidate further with a base of 10,500. In case the market move upwards, then the resistance may be up to 10,750-10,800 levels, they said.

“Ending the week below 30-EMA on the daily chart is not so encouraging for the bulls. Hence, we don’t rule out the possibility of further correction towards 10,580, 10,560, and 10,500. On the flip side, pullback from around 10,600 levels may find difficulty breaking out critical resistance placed around 10,700. Hence, the Benchmark Index getting into a trading band of 10,600 to 10,700 in the first of the week is likely,” Stewart & Mackertich said.

Hence, thorough technical study of the weekly as well as the daily chart patterns suggests, Nifty broader trading range for the coming week is expected to be 10,500-10,800, the research house feels.

The option data also suggests a strong support at 10,500 with an open interest (OI) of 54 lakh shares in put options. Any breakdown below these levels will trigger the next round of correction. On the upside multiple resistances continue in region of 10,780-10800 levels, Vikas Jain, Senior Research Analyst, Reliance Securities said.

On Friday, maximum Put OI was placed at 10,500 followed by 10,600 strikes while maximum Call OI was placed at 11,000 followed by 10,800 strikes. Meaningful Call writing was seen at 10,600 followed by 10,700 strikes which are restricting its upside momentum while Put unwinding was seen at all the immediate strikes which are providing scope for further decline.

Listing

Non-banking finance company Indostar Capital Finance is set to debut on exchanges on Monday. The final price is fixed at Rs 572 per share.

The Rs 1,844-crore initial public offer was subscribed 6.8 times during May 9-11, which suggests that the listing could be in the range of Rs 575-600 levels, sources told Moneycontrol.

Stocks in Focus

Dalmia Bharat has reported a 2.6 percent decline in profit at Rs 209 crore and 8 percent increase in revenue with margin contraction of 360 basis points YoY.

Bhushan Steel will remain in focus as Tata Steel took over the company by paying Rs 35,200 crore to financial creditors. The stock rallied nearly 18 percent in the passing week.

South Indian Bank: RBI has imposed Rs 5 crore penalty on the bank for non-compliance in norms related to IRAC, KYC Norms, treasury function.

Reliance Communications said it is filing appeal against as also application for stay of against the Insolvency & Bankruptcy Code order dated May 15 passed by NCLT, Mumbai bench in National Company Law Appellate Tribunal.

Tata Chemicals has posted a 23 percent increase in March quarter profit at Rs 356 crore and 1.7 percent rise in revenue with margin expansion of 130 basis points YoY.

AU Small Finance Bank will raise Rs 1,000 crore via sale of equity, issue of convertible warrants and these funds will be raised from unit of Singapore-based Temasek Holdings. Indiabulls Real Estate board has approved share buy back plan worth Rs 624 crore.

Den Networks has narrowed its March quarter net loss to Rs 10 crore from Rs 60 crore in same quarter last year. Emami: Sebi cleared seven present and former promoters of FMCG company Emami of insider trading charges.

Dalmia Bharat’s March quarter consolidated profit increased 0.8 percent to Rs 183.65 crore YoY. Manappuram Finance’s March quarter profit fell 9 percent to Rs 182 crore YoY.

Parag Milk Foods: The Reserve Bank of India allowed non-resident Indians to raise their stake in company up to 24 percent from earlier limit of 10 percent.

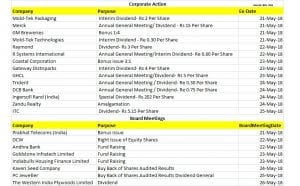

Corporate Action

Global Cues

Japan’s Nikkei Flash Manufacturing PMI for May, US New Home Sales for April, US FOMC Minutes, US Markit Composite, Manufacturing & Services PMI for May and Europe Manufacturing & Services PMI for May will be released on Wednesday.

Federal Open Market Committee will release its minutes for the policy meeting held in May on Wednesday. The Federal Reserve left its interest rate range unchanged at 1.5-1.75 percent, which was in line with expectations.

The US Initial Jobless Claims and April Existing Home Sales will be announced on Thursday. Euro Group Meeting is also likely on the same day.

US Durable Goods Order for April, and Michigan 5-Year Inflation expectations for May will be declared on Friday while European Union Finance Ministers meeting is likely to be held on the same day.