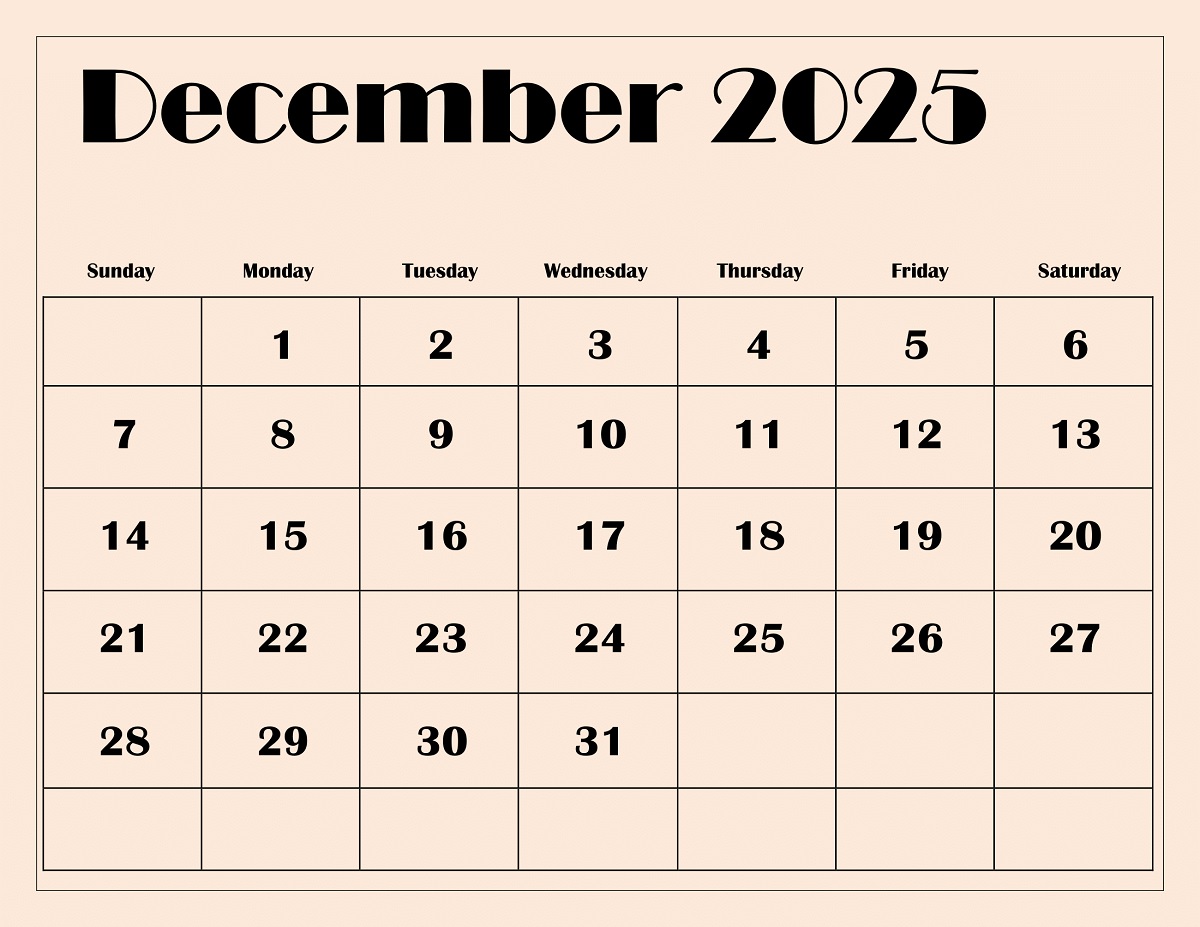

The year 2025 is coming to an end. Along with it, many financial deadlines are also looming. These include belated ITR filing and PAN-Aadhaar linking. December 25th is also a crucial date for NPS investors. Learn all the details…

New Delhi: The month of December is coming to an end. Along with it, many financial deadlines are also approaching. If you’ve been putting off important tasks related to NPS, PAN, or ITR, be careful. According to TOI, December 31st is the deadline for filing your tax returns. Furthermore, linking your PAN and Aadhaar can be a hassle for many. Meanwhile, December 25th is a crucial date for NPS investors.

1. NPS Alert: ‘Scheme A’ is being discontinued

Most people forget about investing in the National Pension System ( NPS ). That is why the recent notice from the pension regulator PFRDA is very important. PFRDA has decided to close Scheme A and merge it with other schemes. The reason is that Scheme A has a small corpus and limited investment scope. It included alternative investments like some REITs, InvITs, AIFs and structured debt instruments. Now it is being merged with Scheme C (Corporate Debt) and Scheme E (Equity). PFRDA says that this will provide better returns and lower risk to the investors.

Why should you pay attention?

If you don’t take any action yourself by December 25th, your money will be automatically transferred to another scheme. You still have the opportunity to change your portfolio without any additional charges.

2. Tax Warning: December 31st is the last chance

This is a late or revised tax return for the assessment year 2025-26 (FY2024-25) . The December 31st deadline for filing or correcting your ITR is not a deadline, but a final warning. If you haven’t filed this year’s return yet or have made any mistakes, this is your last chance to correct them. Delaying it means paying a hefty penalty. Furthermore, you’ll lose the opportunity to adjust your business or stock market losses against next year’s profits. If you fail, you’ll have to pay late fees and interest on the tax. You’ll lose the ability to carry forward your capital market or business losses against next year’s profits. If you miss the December 31st deadline, your only option will be ITR-U (Updated Return). This can be filed up to 48 months after the end of the assessment year. You can’t claim past losses under this deadline, and a penalty tax is applicable on this return.

3. Aadhaar-PAN: December 31 deadline

A new deadline for linking PAN and Aadhaar is ending on December 31st, but it’s not for everyone. This is for PAN card holders who used their ‘Aadhaar Enrollment ID’ instead of Aadhaar number to apply for their PAN. This rule is completely different from the old deadline of June 30, 2023, which was for everyone else. Failure to do so will render your PAN card useless. You will not be able to file your tax return. Higher TDS will be deducted on your income. Your applications for investment, KYC, and even fixed deposits (FDs) may be rejected.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com