How to download lic bond copy online. LIC costumer portal Registration. LIC bond paper is lost. LIC portal login. LIC basic services. How To Get bond online download. LIC policy duplicate copy download . If you have a policy of Life Insurance Corporation of India and you want to download its bond paper, then this post is for you.

What is a Policy Bond?

A policy bond is an important document furnished by LIC when issuing an insurance policy to a customer. Once the policyholder’s proposal is accepted by LIC, a legalised policy bond is provided that predominantly contains the conditions and privileges made available to the policyholder. LIC covers the risk only after the policyholder has accepted the said proposal.

LIC Policy Bond

Whenever you buy a policy of Life Insurance Corporation of India, you are given its bond papers after a few days. In This Bond, you know the sari of the policy done by you. Like what is the name of the policy, what is the plan number. Where did you buy the policy from. What is the maturity date of the policy. How much is the premium monthly, quarterly, quarterly or yearly. If you have purchased an endowment plan, then how much money you have paid. Your name, the name of the nominee, your city address.

The bond of your LIC policy is very important for you. Because you get all the information about the policy. Now the question is whether your policy bond has been lost or forgotten somewhere. If your policy is not binding then what do you do now?

How to Get Duplicate LIC Policy Bond?

If you do not have the bond of your policy. So you follow the post till the last. Because we are telling you with niche details, how you can download duplicate copy of your LIC policy. Sitting at your home, from your mobile computer or laptop. Knowing your policy saree is written on this paper. So let’s go to how to download duplicate copy of LIC policy bond.

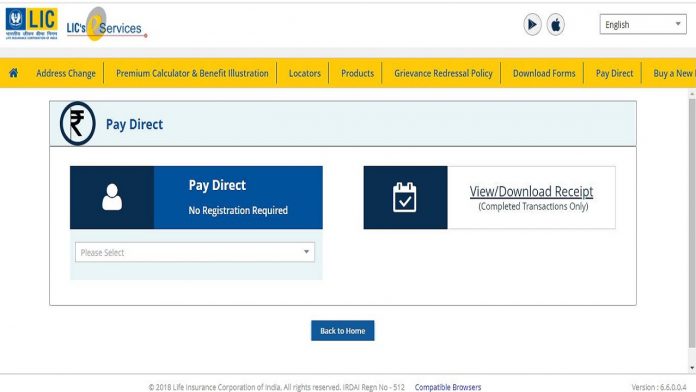

Click on this link to download LIC Policy Bond copy: licindia.in

Step No. 1: To download LIC Policy Bond copy, first you need to do LIC Portal Registration by tabbing on New User.

Step No. 2: If you have registered earlier then login to LIC Portal by tabbing on Registered User.

Step No. 3: After login to the LIC Portal, tab on Basic Services.

Step No. 4: Now tab on Policy Schedule.

Step No.5 : After doing that on the policy schedule your saree policies are looking fine.

Step No. 6: Click on download in front of you have to download the bond paper copy of policy.

Step No.7: Now your bond copy has been downloaded. In this, all the details of your policy are written.

Step No. 8: Now you can print and keep it with you. Or you can download and keep it in your mobile computer or laptop.

How To Download LIC Premium Payment Receipt Online?

To download the LIC premium payment receipt online, you need to be a registered user of LIC’s e-Services.

Step 1: Visit LIC Homepage and click on the link called LIC e-Services that is available on “Online Services”.

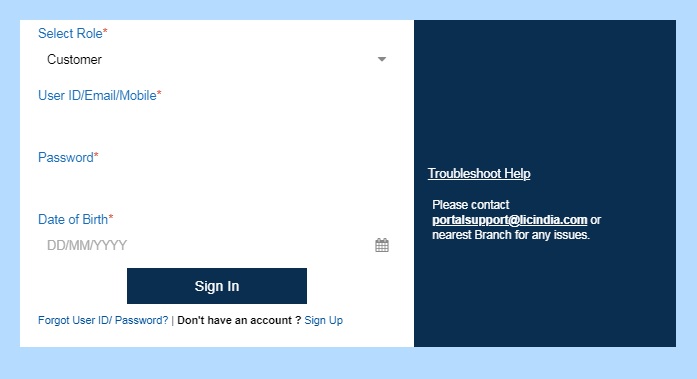

Step 2: Click on the tab “Registered User”. Because you are already a registered user.

Step 3: Submit the User ID and Password. If you forget the User ID and Password, then you can use the link provided for the same and the screen looks like below.

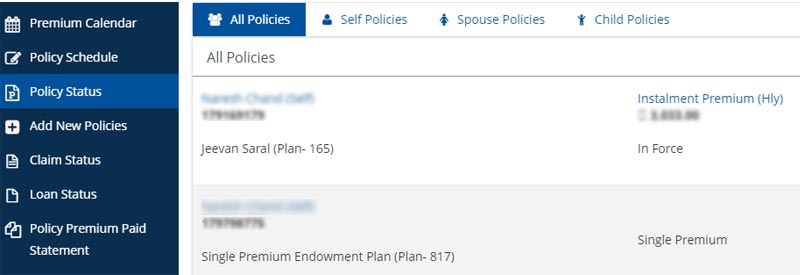

Step 4: Now you will be directed to the Welcome screen of LIC e-Services Page and it looks like below.

Features of LIC’s e-Services?

With the help of LIC’s e-Services, you can do the following activity at ease.

- Check the policy schedule.

- Check policy status.

- Check claim status

- Loan status

- You can generate policy revival quotation

- You can view the policy and proposal images.

- Pay the premium online

- Check the Premium Calendar

- Policy claim history

- Change Password

- Update Profile

- Add or Enroll policies

Along with that, you can also easily download the LIC premium payment receipt online.

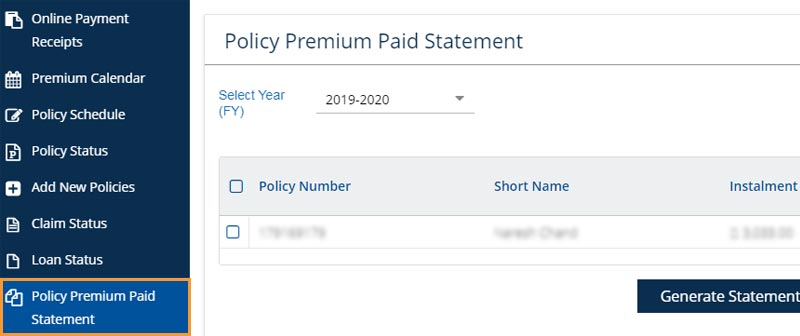

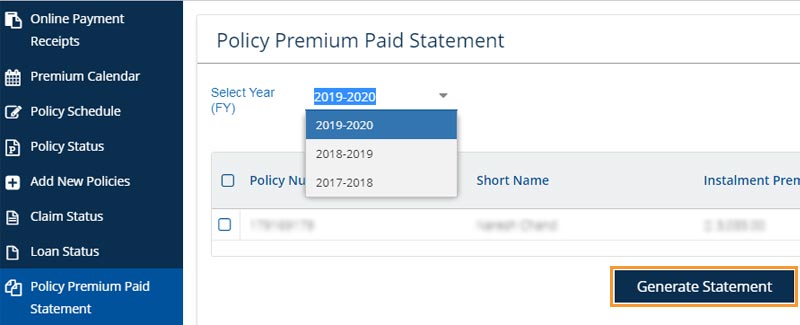

Step 5: Click on the two options available as “Consolidated Premium Paid Statement” or “Individual Policy Premium Paid Statement”.

Consolidated Premium Paid Statement- With the help of this, you can download the premium paid statement of all your policies.

Individual Policy Premium Paid Statement- By using the same, you can download the individual policy premium paid statement.

Step 6: At this step, you have to choose the Financial Year and in case of Individual Policy Premium Paid Statement, select the policy number to download.

Step 7: At this step, you can download the PDF version of the receipt or print the same. You can use the same as the proof of your LIC Policy Premium Paid Receipt.

This is how you can easily download the LIC premium payment receipt online.

Is there any online process to get LIC duplicate bond?

There is no online procedure for getting the duplicate bond copy of the policy, where the customer of Life Insurance Corporation of India must approach concerned service branch for issue of duplicate copy.

How much time does it take for an LIC policy Bond?

LIC will take a minimum of 7 days to maximum of 30 days time for preparing LIC policy bonds and if the policy taken is new, then time for Bond will be more. As the program to print and availability of Blank bond differ.

How to Surrender LIC policy without Bond?

A letter needs to be issued to Life insurance policy starting the loss of bond and a request to be raised to get form to submit the lieu of duplicate policy bond, and also, an amount of 100 Non-judicial stamp paper which is to be notarized with details provided by LIC should be submitted and get the policy amount with showing bond.

Is LIC a good investment or insurance?

The Life insurance policy of India does offer the best insurance policy and if you’re looking for a long-term investment, then this is a best platform to be chosen, So choose Unit Linked Investment Plan or else a later plan like Endowment Plan as based on your risk appetite and financial ability or reasons, to opt for the best insurance plan or term plan for only having insurance.