- Kisan Vikas Patra is extremely beneficial

- Guaranteed to double the amount in 113 months

- You can invest after the age of 18

New Delhi: Every person wants how they can increase their money, but earning money from the stock market is not just a matter of everyone. In such a situation, everyone is looking for safe investment. In which there is profit as well as guarantee of safe money. If you also want to know about any such investment, then Kisan Vikas Patra can be the best investment scheme option for you.

This is a one time investment scheme, where your money doubles in a fixed period (DOUBLE YOUR MONEY). Currently, the maturity period of this scheme is 113 months i.e. less than 10 years. But your money will be safe in this. You can find Kisan Vikas Patra in every post office and bank.

The scheme has been designed by the government to encourage long-term investments and savings to the people. The scheme was launched keeping in mind investors who have money but who do not want to take risk. Let us now tell you all the things related to this scheme-

How much interest is received – If you talk about the second quarter of 2020, the government is paying 7.6% (maturity in 113 months) interest under this scheme.

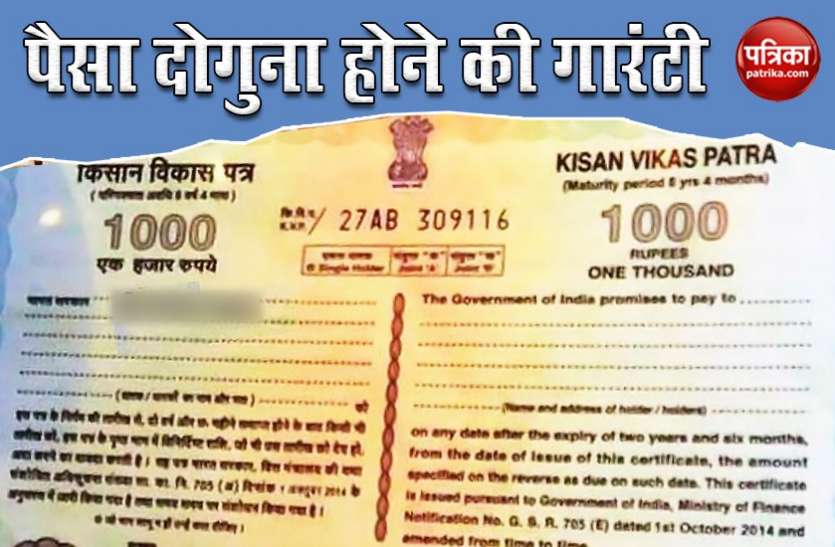

How much you can invest – KVP has certificates up to Rs 1000, Rs 5000, Rs 10,000 and up to Rs 50,000, which can be purchased. That is, you can invest at least 1000 rupees in it and the maximum limit is not set by the government. That is, you can invest as much as you want.

Who can invest- Investor must be at least 18 years of age to invest in Kisan Vikas Patra (kvp). Apart from this, Hindu undivided family ie HUF or NRI cannot be invested in it .

Important Documents – You can open an account by filling the form in any post office or if you want, you can apply for this scheme online also. To open this account, Aadhar card, passport, voter ID card, PAN card should be accompanied by electricity bill or passbook and address certificate for address proof.