Income tax is levied on the basis of a slab system. This means, different tax rates are prescribed for different ranges of income.

New Delhi: Every salaried individual whose pay is beyond a particular income slab, needs to pay tax to the Government annually.

Income tax is levied on the basis of a slab system. This means, different tax rates are prescribed for different ranges of income.

It means the tax rates keep increasing with a rise in the income of the taxpayer. This type of taxation enables progressive and fair tax systems in the country. Such income tax slabs tend to undergo a change during every budget.

These slab rates are different for different categories of taxpayers. Income tax has classified three categories of “individual “taxpayers such as:

- Individuals (aged less than of 60 years) including residents and non-residents

- Resident Senior citizens (60 to 80 years of age)

- Resident Super senior citizens (aged more than 80 years)

New Income Tax Slabs For Financial Year 2021-22 And Assessment Year 2022-23

Due to the crisis that the country faced during 2020, the Central Government had decided not to make any changes to the income tax slab for financial year 2020-21 and carry it on it the new FY 2021-22.

However, there was an exemption made towards the new slab. According to this, senior citizens over the age of 75 who are largely dependent on their pension as well as income interests have been exempted from having to fill out tax returns.

In their cases, TDS (Tax Deducted of Source) will automatically be deducted by banks.

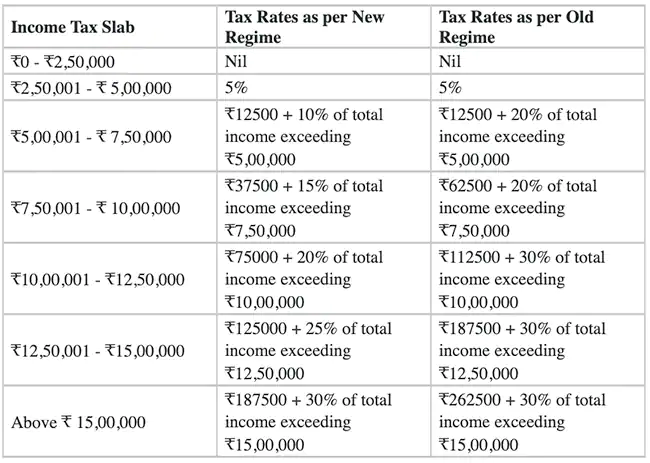

Tax Slab Rates difference between New Tax Regime and Old Tax Regime for FY 21-22 & AY 22-23

How To File Income Tax Return?

Filing income tax returns is no longer the hassle it used to be. Gone are the long queues and endless anxiety of meeting the tax-filing deadline.

With online filing, also called e-filing, it is convenient to file returns from the confines of your home or office and at very short notice.

Mentioned below are the broad steps to file your income tax returns online:

How to Download Income Tax Return?

It is important to how to file ITR on time, to avoid last minute stress and penalties. Once you have filed your ITR, the income tax verification form is generated by the IT department so that taxpayers can verify the validity and legitimacy of e-filing. These are applicable only if you have filed your returns without a digital signature.

The income tax return verification form can be downloaded in easy steps.

- Log in to the Income Tax India website https://portal.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html?lang=eng

View e-filed tax returns by clicking on ‘View Returns/ Forms’ option.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com