The last date for filing income tax returns for the financial year 2021-22 has arrived and the department has also opened the portal for returns. If you also have to fill your ITR, then prepare it and collect all the necessary documents. You will get information about which documents are required for ITR here.

New Delhi. The Income Tax Department has opened the portal for filing returns for the financial year 2021-22. Also, if you are employed, you must have received Form 16 from your employer to file the return. If while the filing of returns has already started, then you will also have to collect the necessary documents for this. What documents will be required and what preparations will have to be done in filing returns this year, complete information is presented here.

PAN-Aadhaar Linking Important

For any taxpayer to file his income tax return, linking PAN and Aadhaar is the most important thing. Although its last date was March 31, 2022, which has ended, but the Income Tax Department has given permission to complete this work with fine. You cannot file your return without linking PAN-Aadhaar.

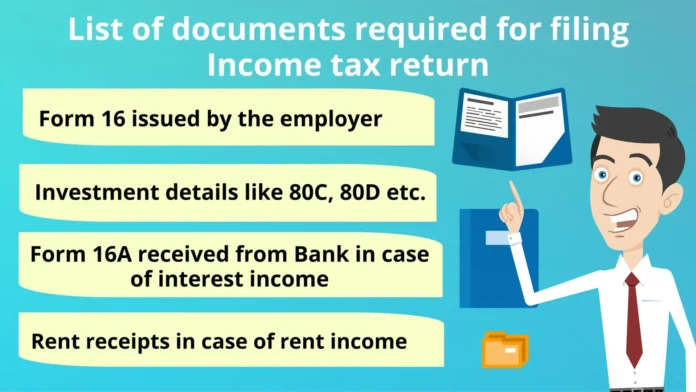

Salaried people usually get Form 16 from their employer, which gives full details of their earnings . Apart from this, before filing the return, you will also have to keep your monthly salary slip and the details of all types of allowances and tax exemption details. If you earn interest, then it can be exempted under section 80TTA of Income Tax, but for this, interest statement will have to be shown on the savings account. The same work will have to be done for FD and TDS certificates as well.

If you take the house on rent and earn income from the residential property,

Then its details will also have to be given in the ITR. Taxes are also levied differently on different house properties. The entire income from house rent is not taxed, but the amount left after deducting the municipal tax and 30 percent standard deduction and home loan interest is to be taxed on the same. You will have to present an interest certificate from the bank for the home loan exemption.

Earnings from the sale of shares

If you invest in the stock market and there is profit from the sale of shares, then it will be considered as income from business. If you have sold the shares after holding them for one year and have gained more than one lakh rupees, then the amount exceeding one lakh will be subject to long term capital gains tax at the rate of 10 per cent. If the shares are sold within a period of less than one year, a direct short-term capital gains tax of 15 per cent will be levied on the profits.

Documents for exemption in 80C

If you have invested in various types of tax saving schemes and want tax exemption under section 80C of income tax, then keep a receipt for it and present it on demand. Investments in PPF, NSC, ULIP, ELSS and life insurance policies have been kept in this section.

Full details of tax in Form 26AS

If you want to give details of TDS or other tax deductions, then Form 26AS has to be kept with you. In this, apart from TDS deduction, all other types of tax collected from you, including advance tax, are accounted for. If there is no match in Form 26AS and Income Tax Return, then there can be an inquiry from the department. Your Form 26AS can be downloaded from the official portal of Income Tax.