ITR Filing Latest Update: To complete the process of Income Tax Return, after filing ITR, you need to E-Verify. If the ITR is not verified within the stipulated time frame, then it is considered invalid.

New Delhi: Every earning person is required to file Income Tax Return (ITR). To complete the process of Income Tax Return, you need to e-verify after filing ITR. If the ITR is not verified within the stipulated time frame, then it is considered invalid. Today here we are going to tell you a very easy way to e-verify after filing ITR online. Let us tell you that you can easily e-verify ITR through your Aadhar card.

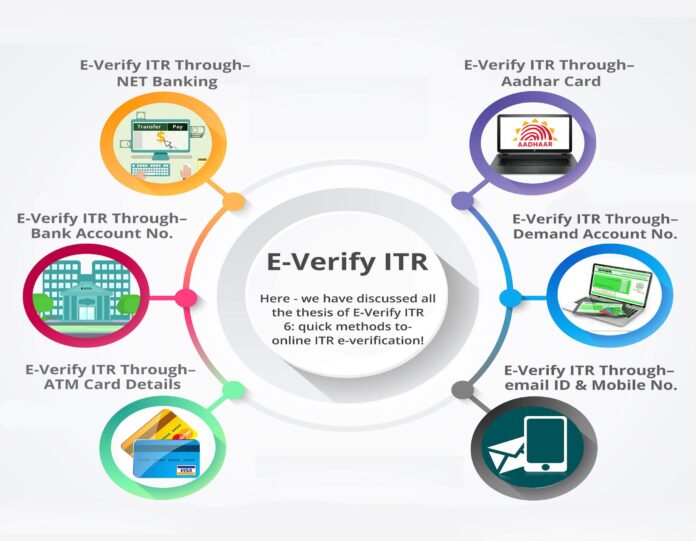

You can do ITR e-verify in these ways

- Through Aadhaar OTP

- By logging into e-filing account through Net Banking

- EVC through Bank Account Number

- EVC through Demat Account Number

- EVC through Bank ATM

- By sending signed copy of ITR-V through post to CPC, Bengaluru

How to E-Verify ITR through Aadhaar

Step 1: Go to https://www.incometax.gov.in to access your e-filing account .

Step 2: Select the E-Verify Return option under Quick Links.

Step 3: In this, select Verify using OTP on the mobile number registered with Aadhaar. Then click on e-Verify screen.

Step 4: Select ‘Agree to verify Aadhaar details’ as checked on the Aadhaar OTP screen. Then click on Generate Aadhaar OTP.

Step 5: After entering the 6-digit OTP sent to your Aadhaar-registered mobile number, click on Validate.

Step 6: Remember that this OTP is valid for 15 minutes only. You will be given three chances to enter the correct OTP. You will also see an OTP expiry countdown timer on the screen, which will notify you when the OTP is received. Whereas when you click on Resend OTP, a new OTP will be generated and you will get it.

Step 7: Now a page with the success message and transaction ID will appear. Keep the transaction ID safe for further use. A confirmation message will also be sent on the e-mail and mobile number that you have given on the filing portal.