Income Tax Refund: Many taxpayers have either not given some of their information in their return while filing ITR (ITR Filing) or have not validated the bank details, due to which their refund is not being processed.

Income Tax Refund: The date for filing Income Tax Return and e-verifying your return by August 31 has passed, however, there are many taxpayers whose tax refund has not yet come. And the Central Board of Direct Taxes (CBDT) has also given an update on this. The board says that many taxpayers have either not given any information in their returns or have not validated the bank details while filing ITR, due to which their refund is not being processed.

CBDT released data on ITR Filing

The CBDT said on Tuesday that more than 6.98 crore income tax returns have been filed for the income earned in the financial year 2022-23, out of which more than six crore have been processed. CBDT, the apex body related to income tax and corporate tax, said in a statement that in the case of some income tax returns (ITR), the department is not able to process their returns due to non-provision of some information or not taking necessary steps on the part of the taxpayers.

According to CBDT, out of the total ITR filed for the financial year 2022-23, about 14 lakh returns are yet to be verified by the taxpayers. Apart from this, the department has sought additional information related to income from 12 lakh taxpayers and in this regard they have been informed about the e-filing accounts. Along with this, some ITR depositors have not yet verified their bank accounts. CBDT said, “In the tax assessment year 2023-24, till September 5, a total of 6.98 crore ITRs have been submitted, out of which 6.84 crore returns have been verified. More than six crore ITRs ie 88 percent of the total verified returns have been processed.

Why is there a delay in return processing?

Regarding the 14 lakh returns that have not been verified yet, the CBDT said that processing is delayed due to not verifying the returns. He also urged the taxpayers to complete the verification process immediately. Along with this, CBDT has also asked 12 lakh taxpayers from whom additional information has been sought to take immediate steps. One of the major reasons for this is that the taxpayer has not validated his bank account itself. CBDT said that due to non-validation of bank account, it is also unable to send approved refunds. CBDT requested taxpayers to verify their bank accounts through e-filing portal for refund.

How to validate bank account?

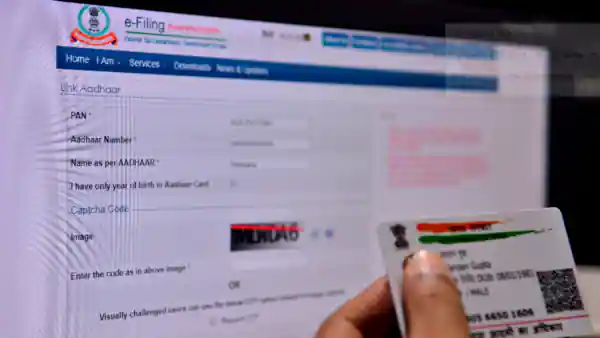

If you also did not validate your bank account in the return, then you can do this work now, so that you can get your stuck refund. For this, you have to go to the income tax website- incometax.gov.in and log in. Now go to your profile, click on bank account and then either add or revalidate your bank account. If you had validated your account, then it may need to be updated and then revalidated. This can happen due to change in details like IFSC Code in the bank account.

Kind Attention Taxpayers!

Your refund can only be credited into a validated bank account. So, please check bank account validation status on e-filing portal.

Pl visit https://t.co/GYvO3mRVUH ➡️ Login ➡️ Profile ➡️ My Bank Account ➡️ Revalidate/Add Bank Account

Previously… pic.twitter.com/nt80jNccxM

— Income Tax India (@IncomeTaxIndia) September 5, 2023

How many ITRs have been processed?

The Income Tax Department has issued refunds to more than 2.45 crore return depositors. After submitting the income tax return, it is necessary to verify it. Only after that the Income Tax Department processes that return and settles refund claims. The average time taken to process ITR was 82 days in Assessment Year 2019-20 and 16 days in AY 2022-23. This time has been reduced to 10 days for AY 2023-24.