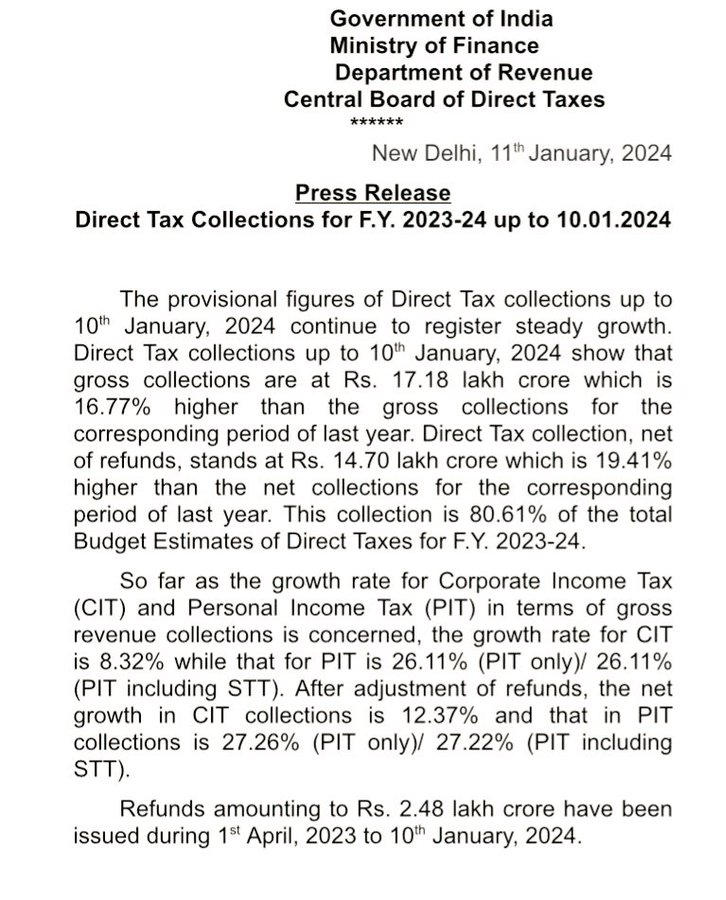

Income tax refund: Tax refund of Rs 2.48 lakh crore has been issued to taxpayers till January 10, 2024. The Income Tax Department has given this information.

Income Tax Department has released the status of tax refund. A total tax refund of Rs 2.48 lakh crore has been issued to taxpayers till January 10, 2024. According to the Income Tax Department, Rs 2.48 lakh crore has been refunded to taxpayers from April 1, 2023 to January 10, 2024 for the assessment year 2023-24.

Did you get income tax refund?

Explain that after filing income tax return for the same period, you can be entitled to income tax refund only if you have paid more tax than your actual tax obligation. The thing to note is that the income tax refund will not be available until the confirmation comes from the department that your ITR has been filed.

Know the status of refund sitting at home

If you too had filed a return and have not received the refund, then you can check from home. In an easy way you can know the status of the return (Income Tax Refund Status). If it has not been received yet or there is some mistake in the return or the refund is stuck due to some other reason, then you can find out.

You can check online

Those taxpayers who are waiting for their refund or do not know the status (Income Tax Return Refund Status), then they can check the status by visiting the official website of the Income Tax Department, incometaxindiaefiling.gov.in . Status can be checked only online. Whenever a refund comes to your account, a notification is sent to your registered mobile and email address.

How to check on e-filing?

- First go to www.incometaxindiaefiling.gov.in

- Login to your account by filling PAN, password and captcha code details

- Click on ‘Review Returns/Forms’

- Select ‘Income Tax Returns’ from the drop down menu.

- Select the assessment year for which you want to check the IT refund status.

- Click on your acknowledgment number ie hyperlink.

- Now a pop-up will appear on the screen, which will show the timeline of return filing. For example, when was your ITR filed and verified, date of completion of processing, date of refund issue, etc.

- Apart from this, it will also show the assessment year, status, reason for failure and mode of payment

Check status like this on NSDL website also

Visit https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

Enter your PAN details

Select the assessment year for which you want to check the refund status

Enter the captcha code and click on submit, now a message will appear on the screen based on the status of your refund

Fill the bank account details correctly

Many times it happens that even after the refund is issued by the Income Tax Department, the taxpayers are not able to get the refund. A major reason for getting refund stuck can be wrong bank account information. If you had entered the account details incorrectly while filling the form, the tax refund may get stuck. In such a situation, you will have to correct the account details on the website of the Income Tax Department. After that you will again be eligible for this refund.

Where to complain if refund is not received

Taxpayers can lodge complaints on incometax.gov.in. They can also use the toll-free number 1800-103-4455 issued by the IT Department. This number can be called on working days between 8 am to 8 pm. Apart from this, complaints can also be lodged on the e-filing portal of the Income Tax Department.