New Delhi: With the increasing facilities of digital banking and banking fraud cases are also increasing continuously. Therefore, it has become very important to pay attention to safety. It has also become extremely important to take care of the security of the checkbook. Please tell that Indian banks keep issuing guidelines from time to time to avoid banking fraud. However, fraudsters also try to cheat in different ways. It is very important to keep the bank’s checkbook safe.

Never make these mistakes while filling the check

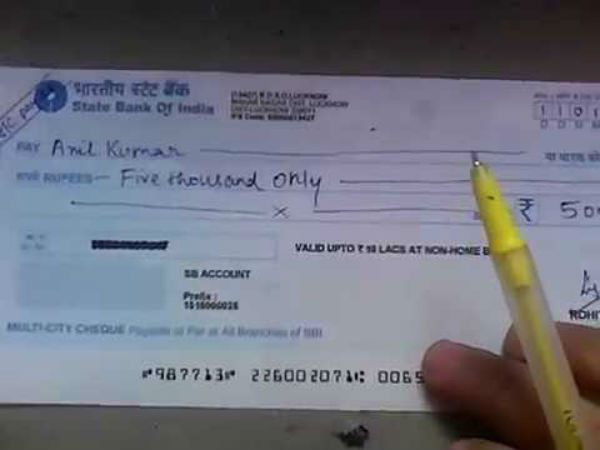

- Checks should always be filled only with Permanent Ink.

- When you go to checkbox in Dropbox, first check Dropbox thoroughly.

- Do not use overlapping handwriting on checks.

- Destroy old checks that have not been used.

- It should be avoided to leave empty space on the check. Keep a record of your check details.

Rules related to check payment will change from January 1

- In the next seven days, the rules related to check payments will change from 1 January 2021 onwards. The rules are being changed to curb banking fraud.

- The RBI has decided to implement a positive pay system for checks from 1 January 2021. Under this system, checks paying more than Rs 50,000 will have to be reconfirmed.

- The person issuing the check will have to electronically re-inform the date of the check, the name of the beneficiary, the recipient and the payment amount.

What is positive pay system

Positive Pay System is an automated tool that will check fraud by checking. Under this, the person who will issue the check will have to re-inform the date of the check electronically, the name of the beneficiary, the recipient and the amount of the payment. The person issuing the check can provide this information through electronic means such as SMS, mobile app, Internet banking or ATM. After this, these details will be cross-checked before check payment. If any irregularity is found, the check will not be paid and the bank branch will be informed about it.

Five important changes under the new rule

The positive pay system is the process of rechecking the details of large paid checks. Banks will apply the new rule to account holders in case of all payments of Rs 50,000 and above. However, the account holder will decide to avail this facility. Banks can make it mandatory in the case of checks of Rs 5 lakh and above. Under the new system, the person issuing the check can give the information of the check through SMS, mobile app, Internet banking and ATM. These details will be double checked before the check is paid. The National Payments Corporation of India (NPCI) will develop a positive pay system and make it available to participating banks. Only those checks that come under the new rule will be accepted under the CTS Grid Dispute Resolution Mechanism. All banks will have to implement the new rule in check clear or collection. Check Payments New Rules: Major changes made by the RBI for the payment of checks, the new system will be applicable from January 1

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com