EPFO provides an option to consolidate all your EPF balances which are lying in different member IDs. All contributions made in the past into EPF while in previous jobs can be transferred to the present employer’s member ID. Thus making things less complicated for future reference.

Salaried individuals often tend to switch companies. The change in employers can make it difficult to remember and track the total provident fund balance. However, there’s a way you can keep yourself easily informed and also consolidate your EPF amount.

The EPFO (Employees’ Provident Fund Organisation) offers a 12-digit unique number known as UAN (Universal Account Number) that can be activated online to keep track of your account details.

UAN acts as an umbrella for multiple member IDs. Member IDs are assigned by the EPFO to the registered companies which helps companies to contribute towards the employee’s EPF balance.

Just like a bank’s passbook, the total EPF amount in your account can be viewed through “e-passbook” link on the EPFO website.

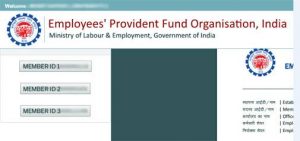

But the problem is that for every member ID the balances are shown separately. The screenshot of the EPFO account of an employee who has changed three jobs is provided below.

Notice that EPF balance of three different jobs are provided through three different links and if total holdings are to be calculated then you would have to add the balances of these three separate member IDs.

It’s always better to have your total EPF holdings displayed in a single window. This would present a better picture of your financial health, especially for schemes like EPF which are meant for long term investments. Primary objective of EPF is to accumulate money in the EPF account which can be used in the sunny days of retirement.

EPFO provides an option to consolidate all your EPF balances which are lying in different member IDs. All contributions made in the past into EPF while in previous jobs can be transferred to the present employer’s member ID. Thus making things less complicated for future reference.

The work is made simpler by the improved online service provided by the EPFO through “One Member – One EPF account” option located in its online services menu. Simply put, this is a transfer request. Through a transfer request all EPF balances against different member IDs is consolidated into one single (present) EPF account.

However online transfer request is accepted by the EPFO only when the below criteria is met:

KYC details are linked with the UAN (Universal Account Number)

Only one transfer request against the previous member ID can be accepted.

If previous / present bank account and IFS code are available.

Personal information shown at the time of transferring is authenticated.

The EPFO website auto populates your personal information which consists of Name, Mobile number, Email, Bank account number, IFSC and Aadhar number. If any of the constituents of personal information are not correct then the same should be first edited and verified in the EPFO records.

The tab below the personal information displays the details of present account into which transfer will be made. This is the most important tab as it contains details of where your money would be moved. UAN, Employer name, Date Of Joining, Member Name, Father’s Name, PF account number, Date of Birth and Company’s Address are constituents of this tab. Cross check these details carefully before proceeding further.

Once details are verified it’s time to go ahead with the transfer request. This can be completed by following two simple steps.

Step 1: Select details of previous accounts which needs to be transferred.

To make things easier, EPFO provides a GET MID button which pulls the information of previous employers. Simply select the previous employers that needs to be consolidated.

Step 2: Authenticating request through OTP

The last step is to authenticate the transfer request using One Time Password (OTP). Once you click on the “Get OTP” option you would receive an OTP on your registered mobile number. On submitting the received OTP your transfer request is complete.

At your end, the only thing left to do is to submit a copy of the transfer request to the administration department of your current employer. A PDF copy of the request made can be downloaded from the “track claim status” option provided by the EPFO in the online services menu. Sample pic is displayed below.

You can expect the balances to be consolidated within 20 days.

It’s also possible that EPF members may have more than one UAN number. This situation can arise due to two reasons. First, while joining a new job the member did not disclose their existing UAN number. Instead they opt for a new EPF account. Secondly, this could be because of not filing of “Date of Exit” by your previous employer in ECR (Electronic Challan cum Return) filing or you have applied for transfer of service in your current establishment.

Having multiple UAN numbers creates a problem while claiming the EPF balance as the PF office would consider the active account only at the time of settlement.

In such a case, you should report the matter to your employer and drop an email to uanepf@epfindia.gov.in. Mention both your current UAN and your previous UAN(s). After due verification, the previous UAN(s) allotted will be blocked and the current UAN will be kept active. Later you will be required to submit a claim to get transfer of service and funds to the current UAN.