Chartered Accountant Shwetanshu Shekhar explains that if you have taken a loan from your father, then he will be showing your income as the interest charged from you. If you have not given this interest yet, then you will have to pay it further.

Filing of returns has become easy in the new website of Income Tax Department and people are also filing returns faster. During this, many types of questions are also coming in front of the taxpayers. One of the important questions among these questions is that if a taxpayer has not paid the interest on the home loan, can he claim tax exemption under section 24 of the Income Tax Act?

The point to be noted here is that people either take loan from the bank or from their brother, father etc. If tax is taken from the bank, then the bank will not leave its interest, it will charge interest from you. But if you have taken a loan from your father, brother and are not in a position to pay interest, then they can give you a moratorium of a few days or a few months.

Tax exemption can be claimed even if interest is not paid

In this regard, chartered accountant Shwetanshu Shekhar says that if you have taken a loan from your father, then he will be showing his income as interest charged from you. If you have not given this interest yet, then you will have to pay it further. That is, you are liable to pay interest.

Now here there is a need to understand the language of section 24 of the Income Tax Act. Section 24 of the IT Act relating to home loans talks of interest payable instead of interest paid. That is, the interest that is payable to you. You have paid or will pay further, it does not make sense.

If you have taken an interest free loan from your father, then you cannot claim tax exemption, but if you pay interest sooner or later (regardless of what you pay), you can claim tax exemption. .

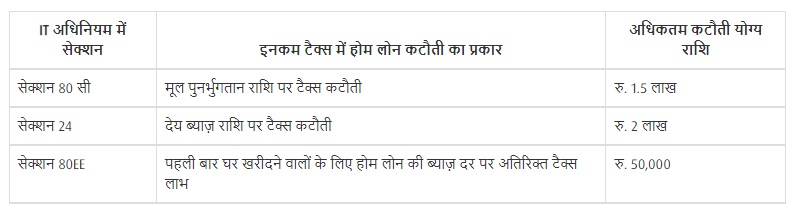

Tax exemption on home loan is available under these sections of the Income Tax Act

Tax Benefits On Home Loan (Source: Bajaj Finserv)

Section 24 of the IT Act: Some important things

A maximum deduction of Rs 2 lakh can be availed on the interest payable amount.

This deduction is applicable to the property whose construction has ended within 5 years.

If the construction is not done within this limit then you can claim only up to Rs.30,000.

For information, let us tell you that in the Union Budget on February 1, 2021, the government has increased the additional tax deduction of Rs 1.5 lakh on the interest paid on home loans for the purchase of affordable homes. That is, now you can take advantage of deduction of up to 3.5 lakhs on home loan till March 31, 2022.