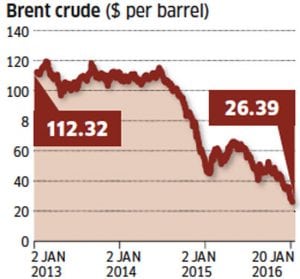

Crude oil prices have topped $80 per barrel for the first time since 2014.

ET Wealth illustrates how change in oil prices impacts the economy, markets and your money.

1. Heightened tensions in the Middle East and lower supply from oil producing countries have led to the recent surge in oil prices.

A global demand recovery has only added to the problem.

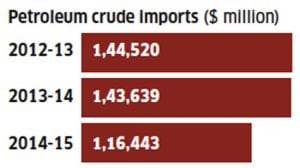

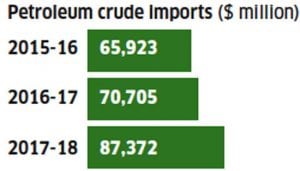

2. India’s significant oil imports (70% of its total consumption) are a big drag on its finances.

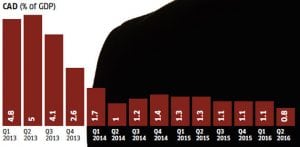

3. Since oil imports form a large chunk of India’s imports, it contributes to the country’s trade deficit. Further rise in crude oil will widen the deficit further.

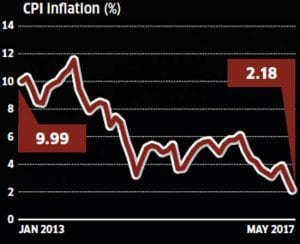

4. Changes in oil prices have a spillover effect on consumer inflation in the country

…but is revving up now

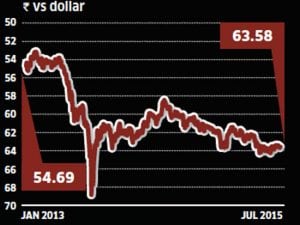

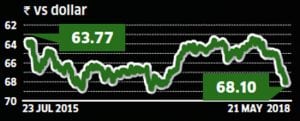

5. Oil price change indirectly impacts the local currency owing to its effects on fiscal deficit and current account deficit. Other factors like slowdown of FII flows have also affected the rupee.

The rupee recovered after an initial slide

Rupee is weakening again as oil marches upwards

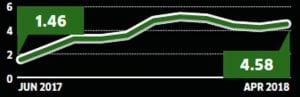

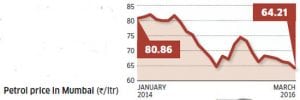

6. Consumers are facing the brunt because taxes now account for more than 50% of the price of petrol

Retail petrol prices had cooled down…

…but moved up due to higher tax

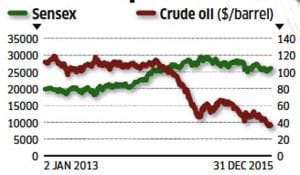

7. There is no sustainable correlation between direction of crude oil price and the stock market. Global economic recovery is aiding stock prices now.

When oil prices dipped, Sensex saw an uptick

Sensex has so far kept pace despite surge in oil prices

8. With every $10/bbl increase in oil price, import bill is estimated to increase by around $8 billion.

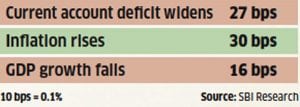

Impact of oil price on different economic indicators For every $10 per barrel oil price rise..