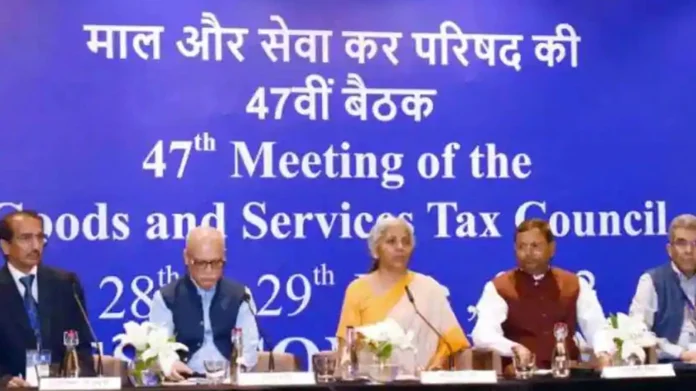

GST Council decision: In the two-day meeting of the GST Council in Chandigarh, the rates of tax on many things have been changed. Due to which many things have become expensive and many are cheap. Let’s see the complete list.

GST Council decision: The GST Council has decided to withdraw the exemption on some goods while increasing the rates on some. After this decision, 5 percent tax will be levied on packed wheat flour, papad, paneer, curd and buttermilk. Union Finance Minister Nirmala Sitharaman said that in the two-day meeting of the GST Council in Chandigarh, the suggestions given regarding rationalization of rates of various groups were accepted. This has led to changes in tax rates. These changes will be effective from July 18.

The meeting will be held again in the first week of August,

Although the GST Council has sent the report on casinos, online gaming and horse racing to the Group of Ministers (GoM) for re-consideration. The Finance Minister said that the GST Council will meet again in the first week of August to decide on this issue. Nirmala Sitharaman said that the next meeting of the GST Council will be held in Madurai, Tamil Nadu in August.

The panel was given an extension of 3 months,

Finance Minister Nirmala Sitharaman told that no decision has been taken in the meeting of the GST Council to increase the GST compensation of the states. There has also been no discussion in the council regarding rate rationalization. For this, the panel has been given an extension of 3 months.

Whose price increased

- Products like packed fish, curd, paneer, lassi, honey, dry makhana, dry soybean and peas etc. These will now attract 5 percent GST.

- The fees charged by banks for issuance of cheques will attract 18% GST.

- Maps and charts including atlas will attract 12 percent GST.

- 12 per cent GST on hotel rooms renting less than Rs 1,000 per day.

- 5 percent GST will be levied on rooms rented above Rs 5,000 in the hospital.

- GST on ‘Printing/Drawing Ink’, Sharp Knife, Paper-cutting Knife and ‘Pencil Sharpener’,

- LED lamp, drawing and marking products has been increased to 18 per cent.

- Solar water heater will now attract 12 percent GST, earlier it was 5 percent.

- Contracts issued for roads, bridges, railways, metro, waste treatment plants and crematoriums will now attract 18 per cent GST. Till now it was 12 percent.

Which things will be cheaper

- GST reduced from 12 to 5 percent on equipment connected with transportation of goods and passengers and residual evacuation surgery by ropeway.

- Trucks, vehicles used for transportation of goods including fuel cost will now attract 12 per cent GST instead of 18 per cent.

- Reduced GST from 12 per cent to 5 per cent in some orthopedic line ups.