There were some serious concerns about the rise in fiscal deficit when the government touched 112% of its full year fiscal deficit target for fiscal 2017-18 by November 2017 itself.

Every budget is essentially a trade-off between growth and borrowings. Typically economies try to overstep on the borrowing pedal during times of lean growth so that higher borrowings can create a virtuous cycle of more spending and more growth. In technical parlance that is referred to as a Counter Cyclical approach to the fiscal deficit. That is exactly what the Union Budget 2018 announced by Arun Jaitley on Feb 01st has done. So, how has the fiscal deficit shifted vis-a-vis the FRBM targets?

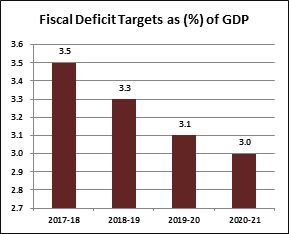

There were some serious concerns about the rise in fiscal deficit when the government touched 112% of its full year fiscal deficit target for fiscal 2017-18 by November 2017 itself. The expectation at that point of time was that the fiscal deficit will overshoot by 50 basis points (i.e. it will be 3.7% against the original target of 3.2%). Against these expectations, Arun Jaitley has allowed the fiscal deficit to increase to just 30 basis points to 3.5% for fiscal year 2017-18. Even for the next fiscal year, the fiscal deficit has been pegged at just 3.3% of GDP (against the original FRBM target of 3%). More importantly, the Union Budget has also provided guidance for fiscal deficit and government borrowings for the next three years…

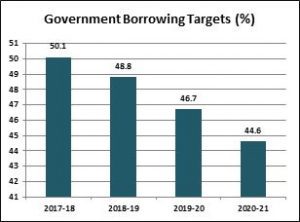

The borrowing guidance for the next three fiscal years.

The two charts above capture the budget projections of the fiscal deficit and the government borrowings as a percentage of GDP. What is important here is that the fiscal deficit is covered up by debt and equity flows whereas government borrowings are purely the debt of the government of India. At 50% plus, the level is currently a roadblock when it comes to upgrading of India’s sovereign ratings and that was one of the major reasons mentioned by S&P when it refrained from upgrading India’s sovereign ratings despite Moody’s giving a thumbs up. That is why this guidance on government borrowings is equally important. The good news is that despite the counter cyclical policy, the budget has only delayed the 3% fiscal deficit target by two years and even in the next two years it is only exceeding the FRBM target by 30 basis points.

The real good news is about where the money is going

As we said, this is the real good news! It is not about how much the fiscal deficit is increasing by where exactly is this higher borrowing going. The second question is whether there is traction on the revenues front. Consider the following key points…

• There is obvious traction on the revenues front. The fiscal year 2016-17 had set a divestment target of Rs.72,500 crore and it likely to end up closer to Rs.100,000 crore. The target for next year is Rs.80,000 crore, so if one assumes a 40% mark-up then we could end the next fiscal year above the Rs.110,000 crore on divestments alone. And why not? After all, there are 24 CPSEs lined up for divestment and these include an eclectic mix of minority stake sales and strategic investments. Secondly, on the direct tax front there has been a sharp growth in the number of direct tax payers and also the expectation that GST should start yielding higher revenues in the next fiscal once the processes are more stable.

• Let us not forget that there has been a big outlay in this budget for the infrastructure sector. At the outset, infrastructure has strong externalities and is growth accretive with a multiplier effect. Consider some of the numbers. There is an allocation of Rs.5.9 lakh crore for infrastructure and an outlay of Rs.148,000 crore for Railways. In the last year the government has completed 9000 KM of highways and is on target to reach 35,000 KM in the next 3 years. In addition, the Bharat Mala project and the Sagar Mala project are in full swing and the Freight Corridors are likely to be a big boost. All these have the potential to boost GDP growth by 1-1.5% annually.

• Lastly, the rural focus of this budget cannot be overlooked. One can argue about the political implications of the rural allocation, but the fact of the matter is that at a time of farm distress this is essential. To begin with assuring farmers 1.5 times the cost of Kharif production as MSP is going to be expensive but that is the need of the hour. The budget has a total outlay of Rs.14.34 lakh crore for generating rural livelihoods through farming and non-farming opportunities. The budget also has outlays for 8 crore new cooking gas connections and 4 crore electricity connections. The largest healthcare program will provide a health protection of Rs.5 lakh per family and will cover 10 crore households. All these are likely to be instrumental in improving rural quality of life and rural purchasing power. Their impact on growth and consumption will be a big story in the coming year.

Three reasons the fiscal deficit is not a worry

To cut a long story short, there is not much to worry on the fiscal deficit front. Firstly, the budget has only delayed the fiscal targets by two years and there is a three years window to achieve these targets. Secondly, the fiscal deficit is also matched by higher revenue generation potential in the coming year. Lastly, most of the money is going into infrastructure and rural distress; both of which are likely to drive GDP higher. In fact, this higher fiscal deficit could actually be a counter cyclical blessing in disguise!