People generally see FD as a good return and safe investment option. However, there are many government schemes where you get more returns than FDs. Since the control of these schemes is in the hands of the government, they are much better in terms of security as well.

New Delhi. A common Indian usually thinks about investing his money in FD only. This is because here your money is also safe and the returns are also good. In the long run, this amount grows significantly and a good fund is created. In recent times, banks have also increased the interest rates on FDs, making it more attractive. But do you know that many government savings schemes are giving more interest than FD.

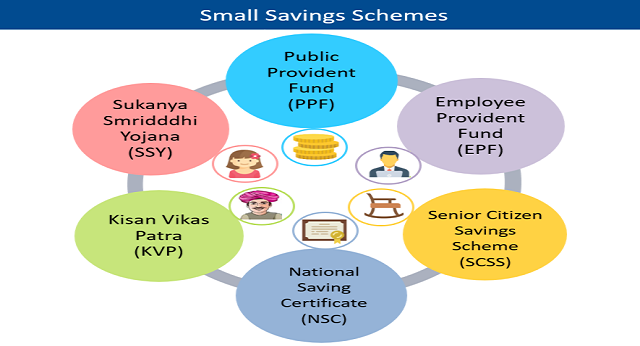

PPF, Senior Citizen Saving Scheme, National Saving Scheme and Sukanya Samriddhi Yojana are some such schemes where you are getting more returns than FDs of many banks. Today we will tell you about these in detail.

Interest rates on FDs of banks

Punjab National Bank is giving a maximum interest of 6.10 percent to the common citizen on FDs. At the same time, it is maximum 6.25 percent for senior citizens. Similarly, SBI is giving a maximum interest of 5.65 percent to the common citizen. Whereas senior citizens are getting maximum interest of 6.45 percent. Talking about private sector banks, HDFC Bank is giving a higher interest of 6.10 percent on its FDs and senior citizens are getting maximum interest of 6.60 percent from the bank. At the same time, ICICI Bank is giving a maximum interest of 6.10 percent to common citizens and 6.60 percent to senior citizens.

Interest on government savings schemes

Annual interest is getting 6.8 percent on National Saving Certificate (NSC) and 6.9 percent on Kisan Vikas Patra. At the same time, 7.1 percent interest is being available on PPF, 7.4 percent on Senior Citizen Saving Scheme and 7.6 percent in Sukanya Samriddhi Yojana. With Monthly Income Account, you are getting an annual interest of 6.6 percent. Explain that the government reviews these interest rates once every three months and there was no change in them in the June quarter.

Tax exemption

You also get tax exemption on investment in government small savings schemes. For example, if you invest in Sukanya Samriddhi Yojana, then you can get the benefit of tax exemption on investment up to Rs 1.5 lakh.