If one or both of the parents were salaried parents and have been a member of the Employee Pension Scheme (EPS), then their children can get financial support. To deposit money in EPS, the company does not deduct money from the salary of its employee, but some part of the company’s contribution is deposited in EPS.

New Delhi. Lost a large number of loved ones in the country of Corona virus epidemic. Even many children became orphans. There were many such reports that all the members of the family died due to corona and the children became orphans. Financial support can be available for such orphaned children under the Employee Pension Scheme (EPS). However, this benefit will be available to those orphan children, whose parents were either salaried or have been EPS members. The Employees Provident Fund Organization (EPFO) has tweeted about the benefits (EPS Benefits) to the orphan children under the EPS scheme.

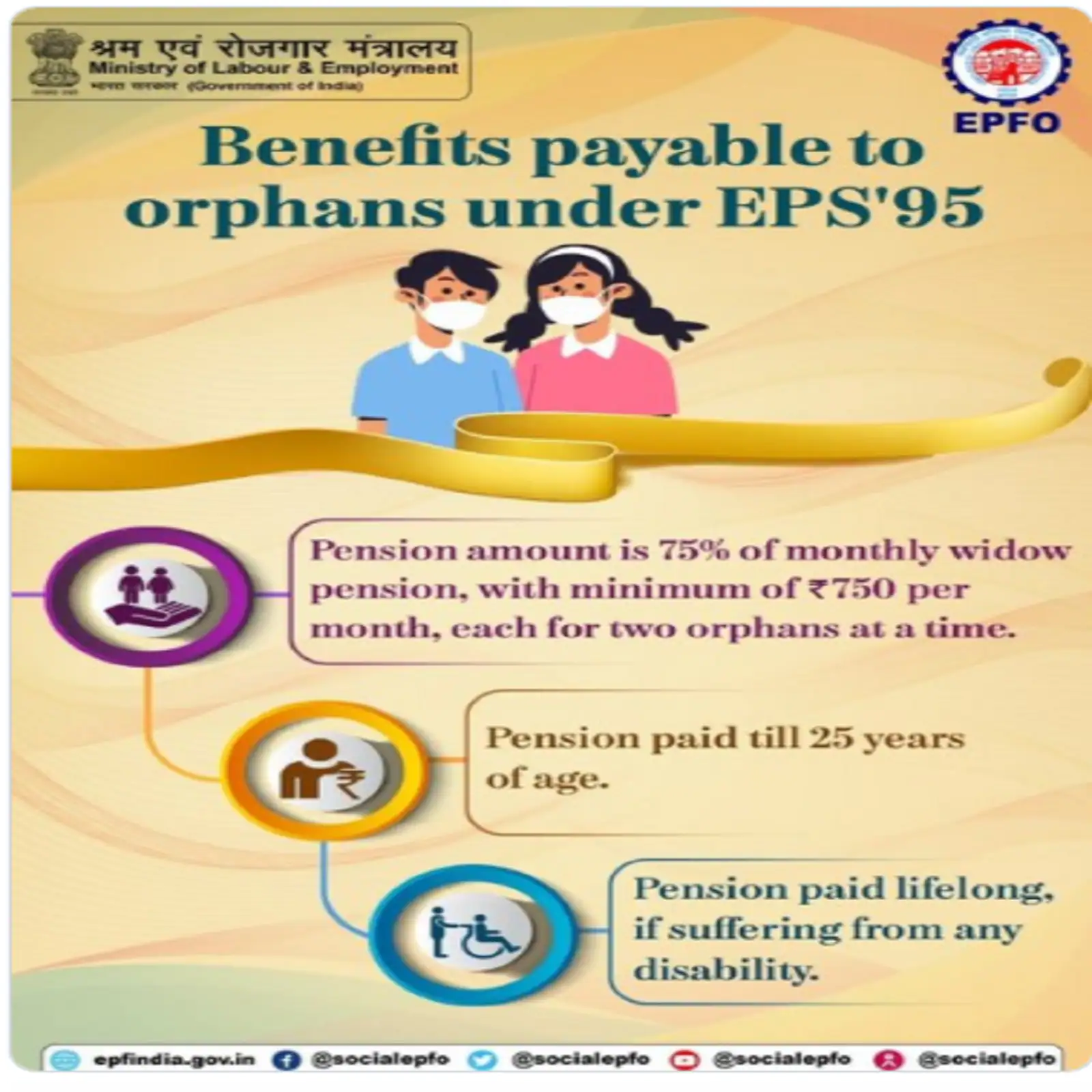

What are the benefits of orphan children under EPS?

- The amount of pension to orphan children will be 75 percent of the monthly widow pension. This amount will be at least Rs 750 per month.

- At a time, each of the two orphan children will get a pension amount of Rs 750 per month.

- Under the EPS scheme, orphan children will be given pension till the age of 25.

- If the children are suffering from any disability then they will be given pension for life.

Will there be any payment for EPS?

- For EPS, the company does not deduct any money from the employee’s salary.

- Some part of the company’s contribution is deposited in EPS.

- Under the new rule, those with basic salary up to Rs 15,000 will get this facility.

- According to the new rule, 8.33 percent of the salary is deposited in EPS.

- On having a basic salary of Rs 15,000, the company deposits Rs 1,250 in EPS.

Life certificate to be submitted for pension

Pensioners are required to submit life certificate or digital life certificate for pension payment under the Employees’ Pension Scheme-1995 (EPS-95). Every year pensioners are required to submit life certificate or life certificate. Due to this there is no obstacle in getting pension. Now the facility of submitting life certificate through video call has also been started.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at businessleaguein@gmail.com